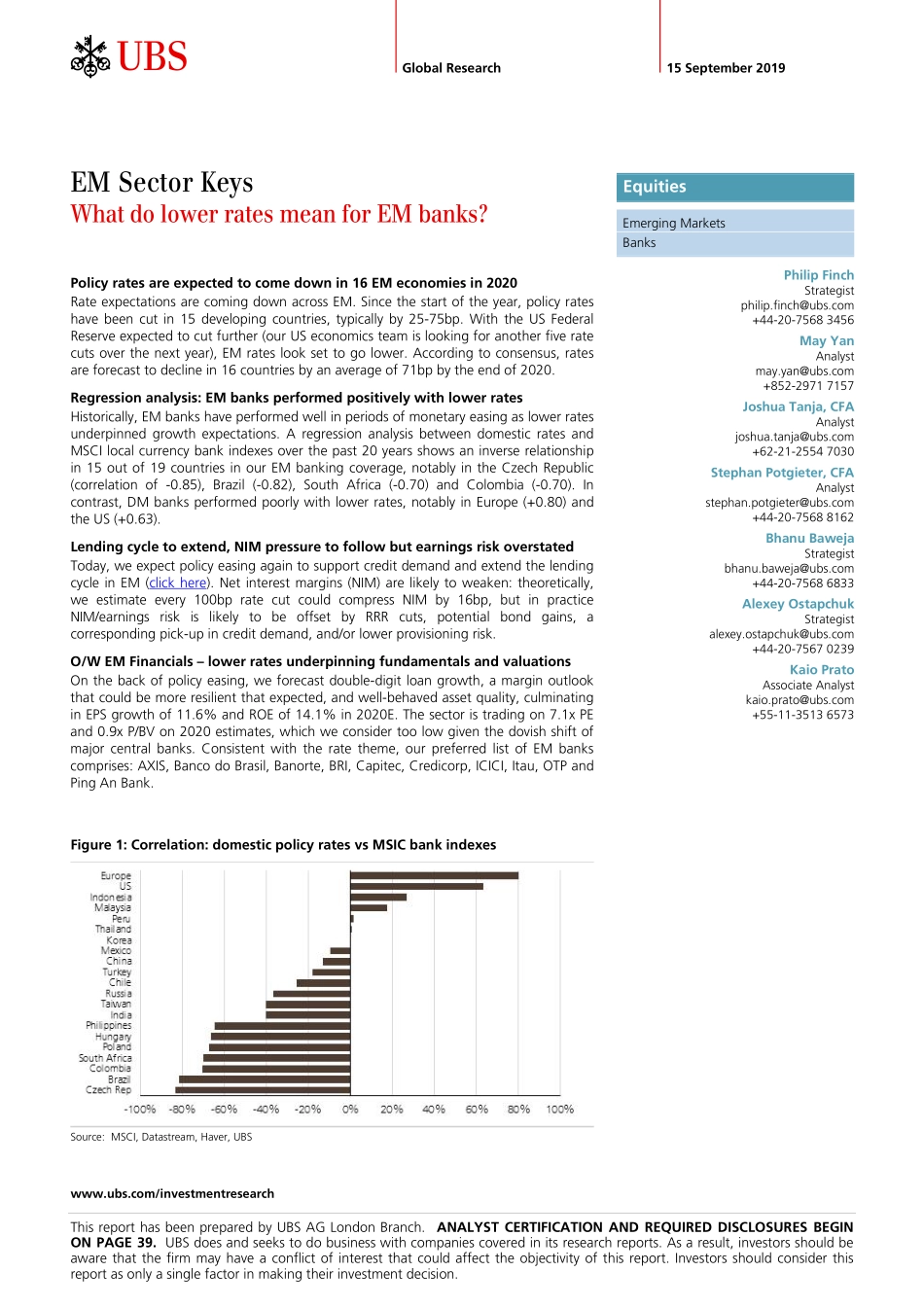

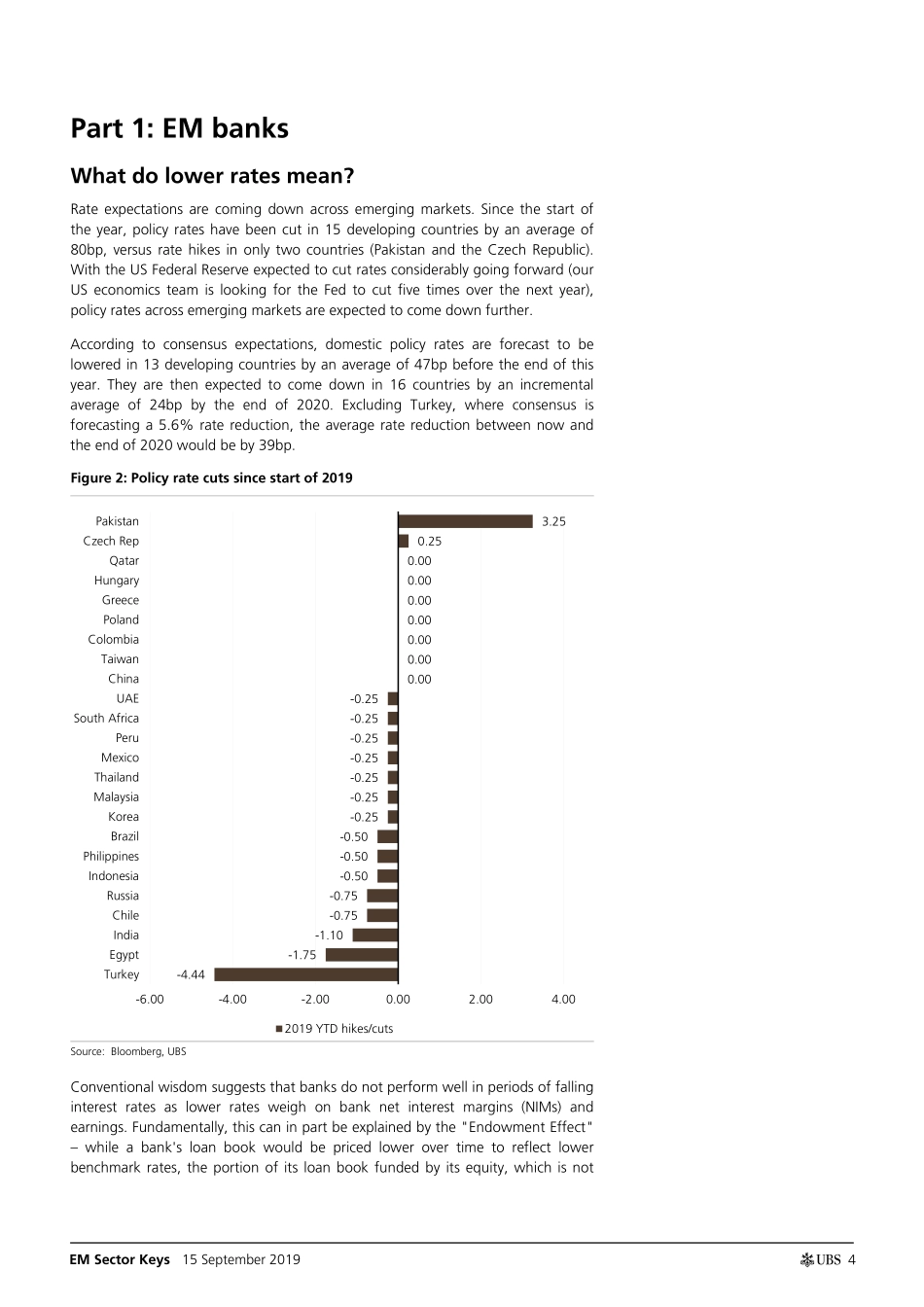

www.ubs.com/investmentresearch This report has been prepared by UBS AG London Branch. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 39. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 15 September 2019 EM Sector Keys What do lower rates mean for EM banks? Policy rates are expected to come down in 16 EM economies in 2020 Rate expectations are coming down across EM. Since the start of the year, policy rates have been cut in 15 developing countries, typically by 25-75bp. With the US Federal Reserve expected to cut further (our US economics team is looking for another five rate cuts over the next year), EM rates look set to go lower. According to consensus, rates are forecast to decline in 16 countries by an average of 71bp by the end of 2020. Regression analysis: EM banks performed positively with lower rates Historically, EM banks have performed well in periods of monetary easing as lower rates underpinned growth expectations. A regression analysis between domestic rates and MSCI local currency bank indexes over the past 20 years shows an inverse relationship in 15 out of 19 countries in our EM banking coverage, notably in the Czech Republic (correlation of -0.85), Brazil (-0.82), South Africa (-0.70) and Colombia (-0.70). In contrast, DM banks performed poorly with lower rates, notably in Europe (+0.80) and the US (+0.63). Lending cycle to extend, NIM pressure to follow but earnings risk overstated Today, we expect policy easing again to support credit demand and extend the lending cycle in EM (click here). Net interest margins (NIM) are likely to weaken: theoretically, we estimate every 100bp rate cut could compress NIM by 16bp, but in practice NIM/earnings risk is likely to be offset by RRR cuts, potential bond gains, a corresponding pick-up in credit demand, and/or lower provisioning risk. O/W EM Financials – lower rates underpinning fundamentals and valuations On the back of policy easing, we forecast double-digit loan growth, a margin outlook that could be more resilient that expected, and well-behaved asset quality, culminating in EPS growth of 11.6% and ROE of 14.1% in 2020E. The sector is trading on 7.1x PE and 0.9x P/BV on 2020 estimates, which we consider too low given the dovish shift of major central banks. Consistent with the rate theme, our preferred list of EM banks comprises: AXIS, Banco do Brasil, Banorte, BRI, Capitec, Credicorp, ICICI, Itau, OTP and Ping An Bank. Figure 1: Correlation: domestic policy rates vs MSIC bank indexes Source: MSCI, Datastream, Haver, UBS Equities Emerging Markets Banks...