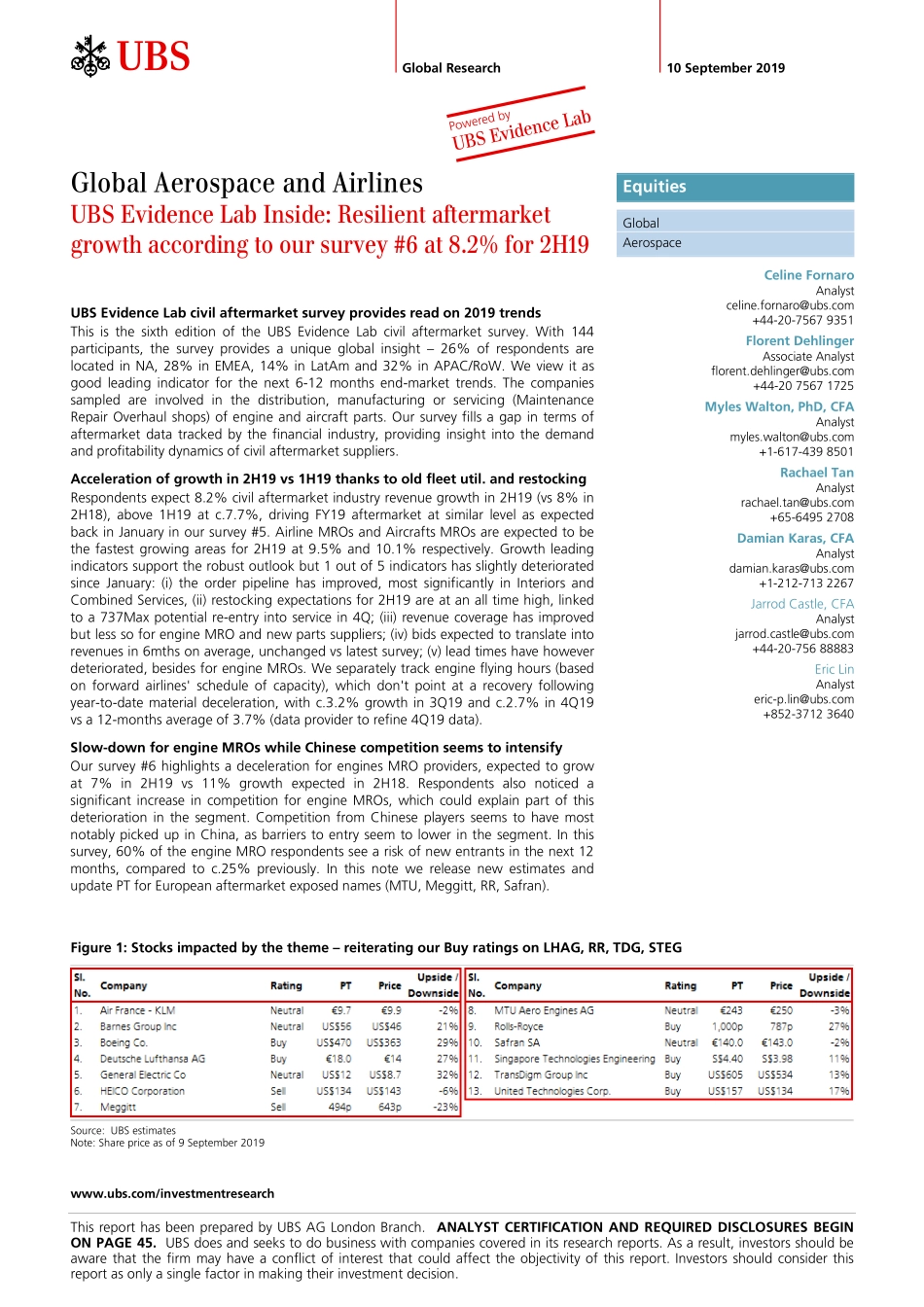

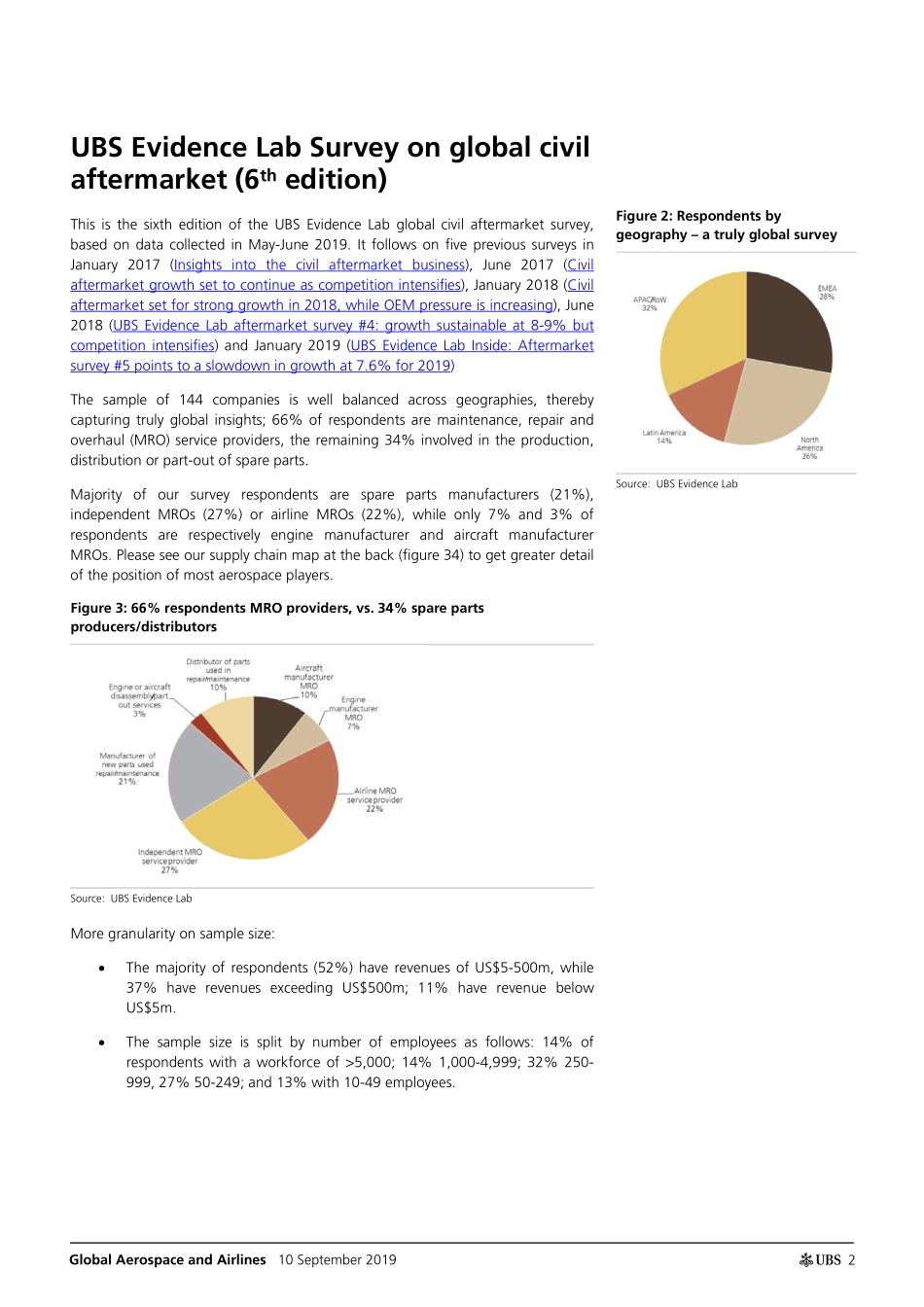

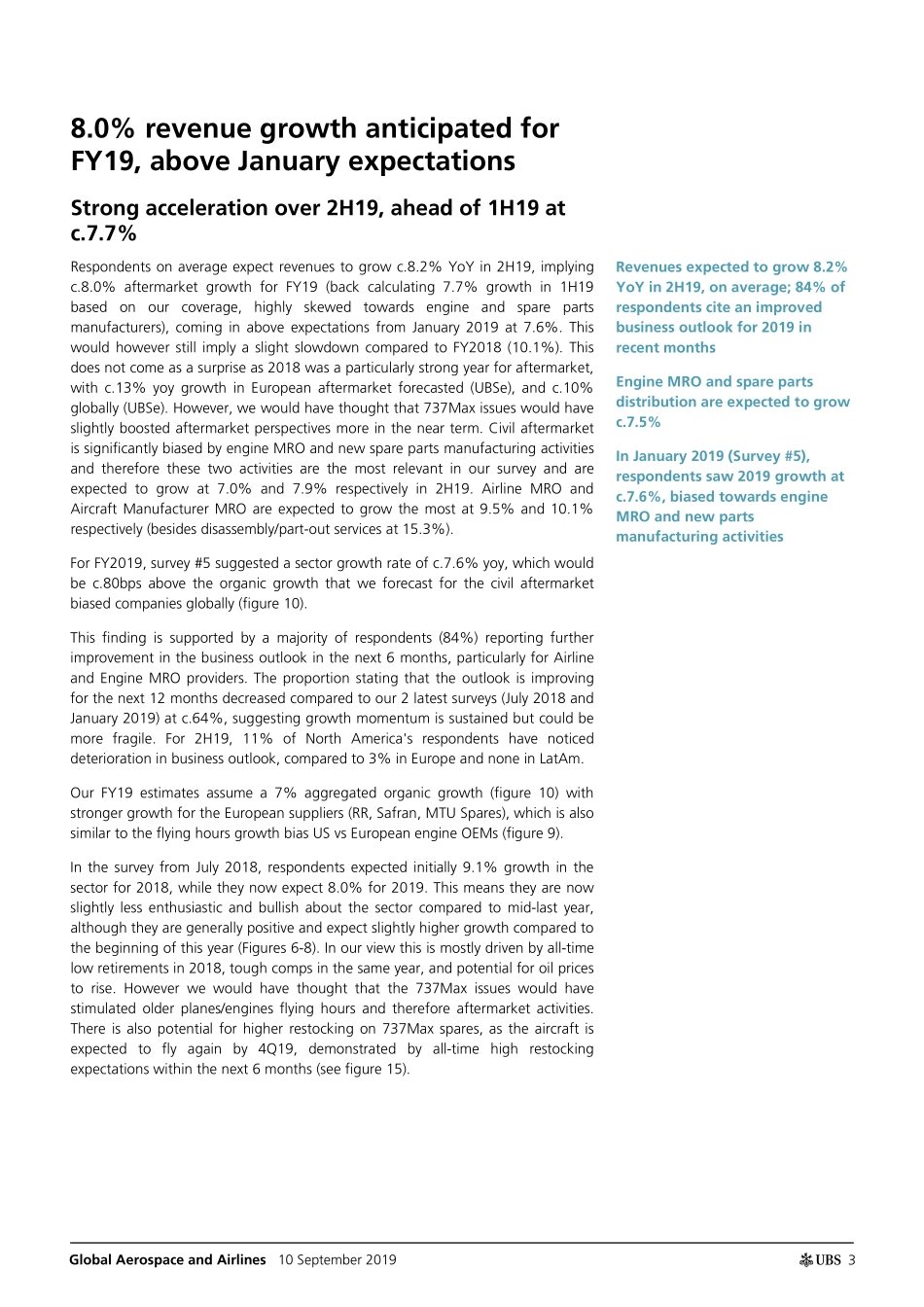

www.ubs.com/investmentresearch This report has been prepared by UBS AG London Branch. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 45. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 10 September 2019 Global Aerospace and Airlines UBS Evidence Lab Inside: Resilient aftermarket growth according to our survey #6 at 8.2% for 2H19 UBS Evidence Lab civil aftermarket survey provides read on 2019 trends This is the sixth edition of the UBS Evidence Lab civil aftermarket survey. With 144 participants, the survey provides a unique global insight – 26% of respondents are located in NA, 28% in EMEA, 14% in LatAm and 32% in APAC/RoW. We view it as good leading indicator for the next 6-12 months end-market trends. The companies sampled are involved in the distribution, manufacturing or servicing (Maintenance Repair Overhaul shops) of engine and aircraft parts. Our survey fills a gap in terms of aftermarket data tracked by the financial industry, providing insight into the demand and profitability dynamics of civil aftermarket suppliers. Acceleration of growth in 2H19 vs 1H19 thanks to old fleet util. and restocking Respondents expect 8.2% civil aftermarket industry revenue growth in 2H19 (vs 8% in 2H18), above 1H19 at c.7.7%, driving FY19 aftermarket at similar level as expected back in January in our survey #5. Airline MROs and Aircrafts MROs are expected to be the fastest growing areas for 2H19 at 9.5% and 10.1% respectively. Growth leading indicators support the robust outlook but 1 out of 5 indicators has slightly deteriorated since January: (i) the order pipeline has improved, most significantly in Interiors and Combined Services, (ii) restocking expectations for 2H19 are at an all time high, linked to a 737Max potential re-entry into service in 4Q; (iii) revenue coverage has improved but less so for engine MRO and new parts suppliers; (iv) bids expected to translate into revenues in 6mths on average, unchanged vs latest survey; (v) lead times have however deteriorated, besides for engine MROs. We separately track engine flying hours (based on forward airlines' schedule of capacity), which don't point at a recovery following year-to-date material deceleration, with c.3.2% growth in 3Q19 and c.2.7% in 4Q19 vs a 12-months average of 3.7% (data provider to refine 4Q19 data). Slow-down for engine MROs while Chinese competition seems to intensify Our survey #6 highlights a deceleration for engines MRO providers, expected to grow at 7% in 2H19 vs 11% growth expected in 2H18. Respondents also noticed a significant increase in competition...