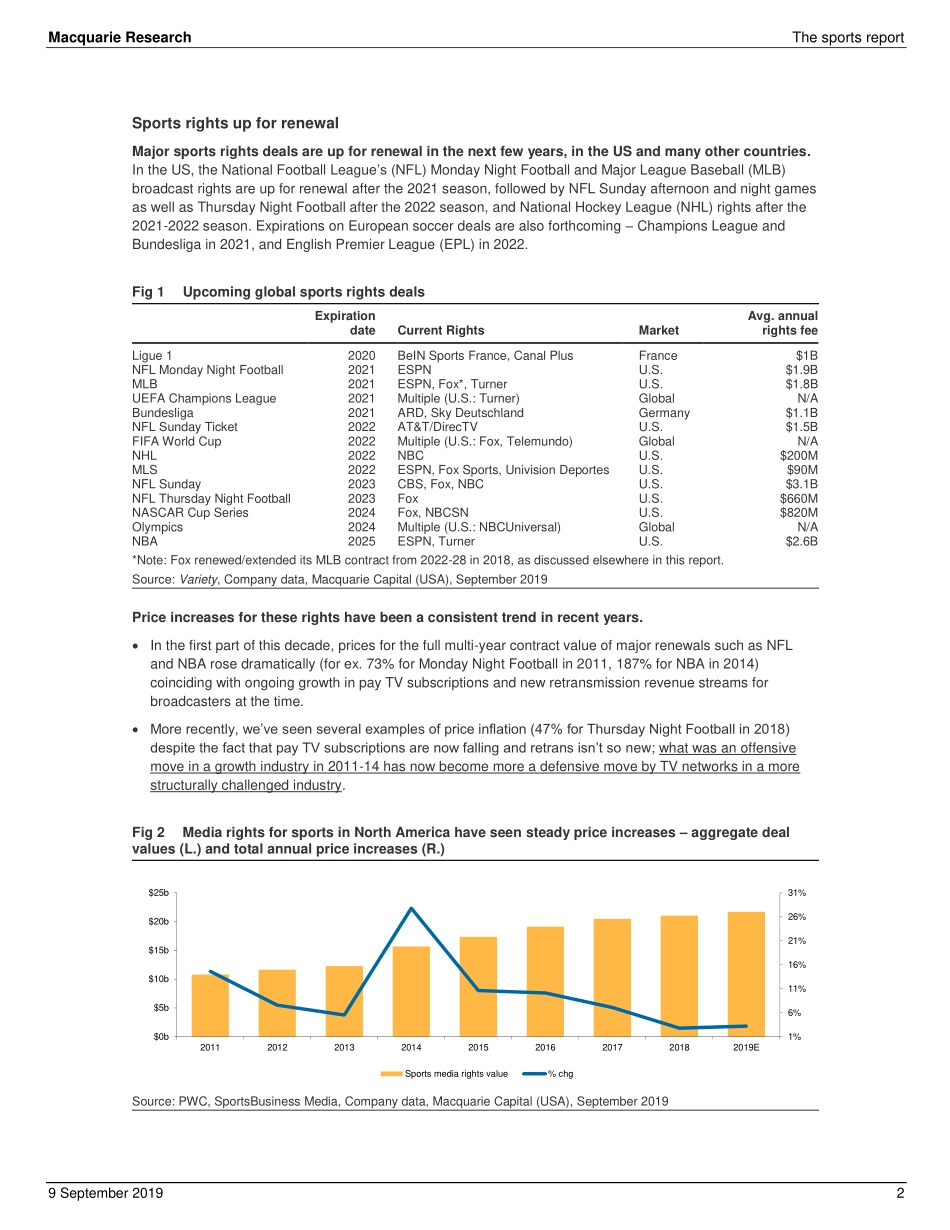

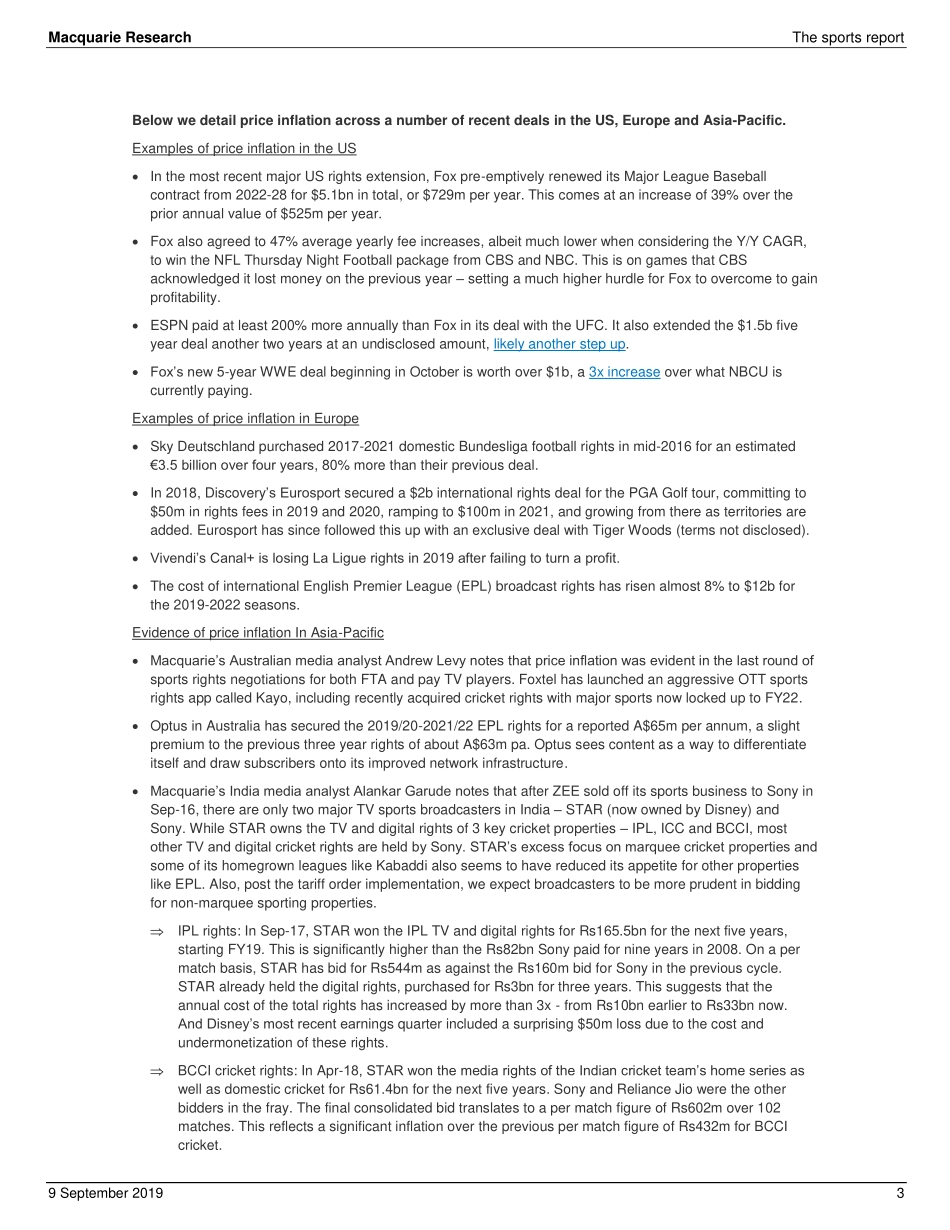

Please refer to page 30 for important disclosures and analyst certification, or on our website www.macquarie.com/research/disclosures. 9 September 2019 Global EQUITIES What’s inside: Upcoming major rights deals by league/year Recent major rights deal price increases in the US, Europe and Asia-Pac – and a few instances of price declines Sports networks’ profit squeeze Sports viewership data trends, and good ratings to start the new football season Details on new US sports betting efforts by Fox and several gaming companies – and how to invest in this What the leagues want – price, but also reach and seamless access; advantage TV What Amazon, Google, Facebook and other internet players are up to – and their likelihood of bidding all-out for exclusive rights. The future: hybrid linear/streaming models, and who can succeed We downgrade FOXA to Underperform and cut our TP to $30. Inside Fox Corporation (FOXA US) 23 Analysts Macquarie Capital (USA) Inc. Tim Nollen +1 212 231 0635 tim.nollen@macquarie.com Chad Beynon +1 212 231 2634 chad.beynon@macquarie.com Benjamin Schachter +1 212 231 0644 ben.schachter@macquarie.com Macquarie Capital (Europe) Limited Guy Peddy +44 20 3037 4509 guy.peddy@macquarie.com Giasone Salati +44 20 3037 2670 giasone.salati@macquarie.com Macquarie Capital Securities (India) Pvt. Ltd. Alankar Garude, CFA +91 22 6720 4134 alankar.garude@macquarie.com Macquarie Capital Securities (Malaysia) Sdn. Bhd. Prem Jearajasingam +60 3 2059 8989 prem.jearajasingam@macquarie.com Macquarie Securities (Australia) Limited Andrew Levy, CFA +61 2 8232 5165 andrew.levy@macquarie.com The sports report Rights, betting, streaming and profit implications for the 2020s Key points TV networks face major sports rights renewals in the next 3 years; internet competitors will likely play a role. Profitability is at risk. Sports betting is an intriguing new business, w/ new ad revenue potential for TV and opportunities for gaming companies like TSG and PENN. Linear+streaming business models will emerge. We downgrade FOXA to UP. Major deals for TV sports rights are upcoming in the early 2020s. In the US NFL, MLB and NHL rights, and in Europe Champions League, Bundesliga and EPL are all up for renewal in 2021/22. Strong price increases for most sports deals has continued into this year, but for TV networks it’s more a defensive play now: live event programming becomes more critical for TV at a time when cord cutting is at risk of accelerating. Profitability depends on the ability to bargain for ever-higher carriage rates and ad CPMs, but network margins have contracted already on rising costs (ESPN down 1,350bps since 2013), and this could get worse. The real risk of large internet companies bidding for exclusive rights adds pressure. We believe forays by Amazon, Google and Facebook into sports content co...