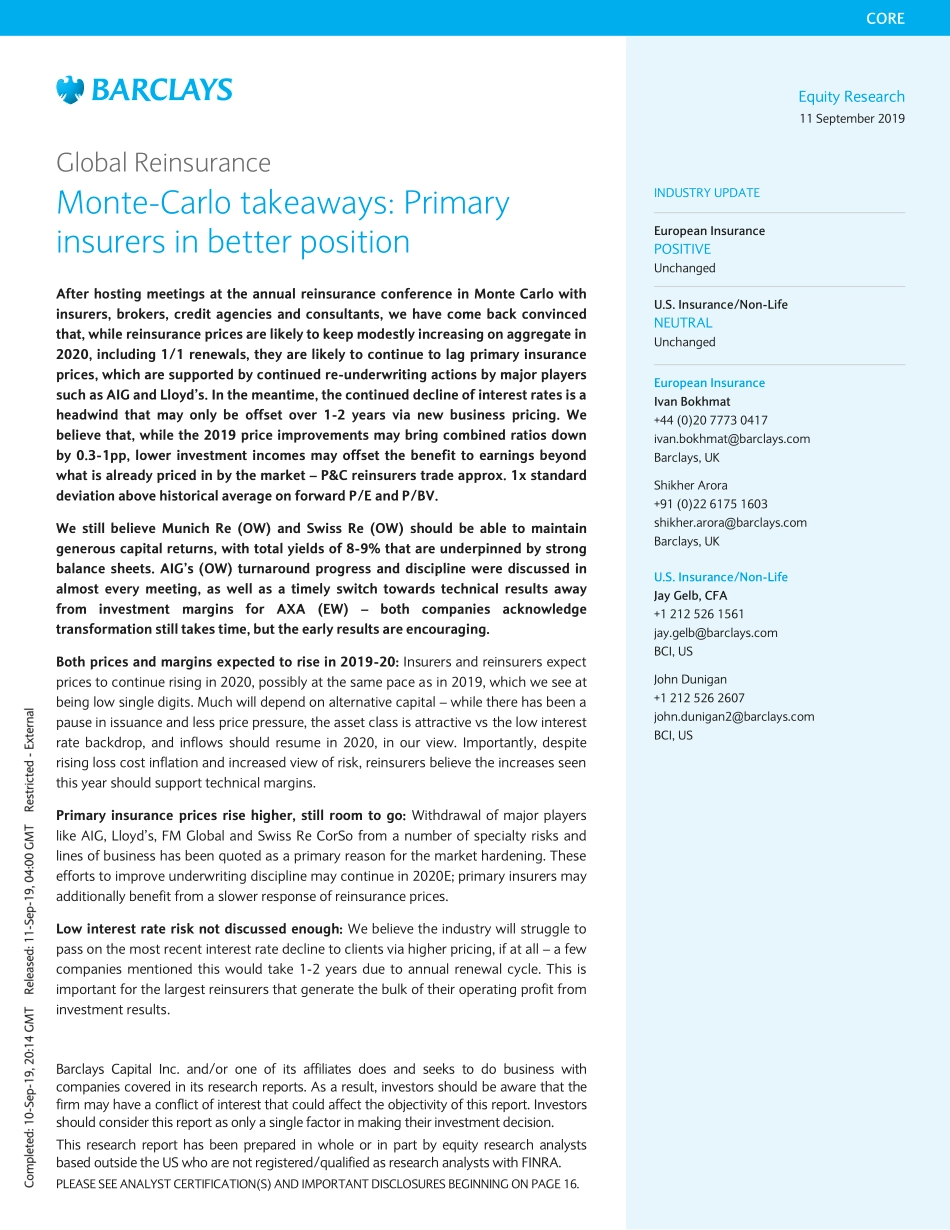

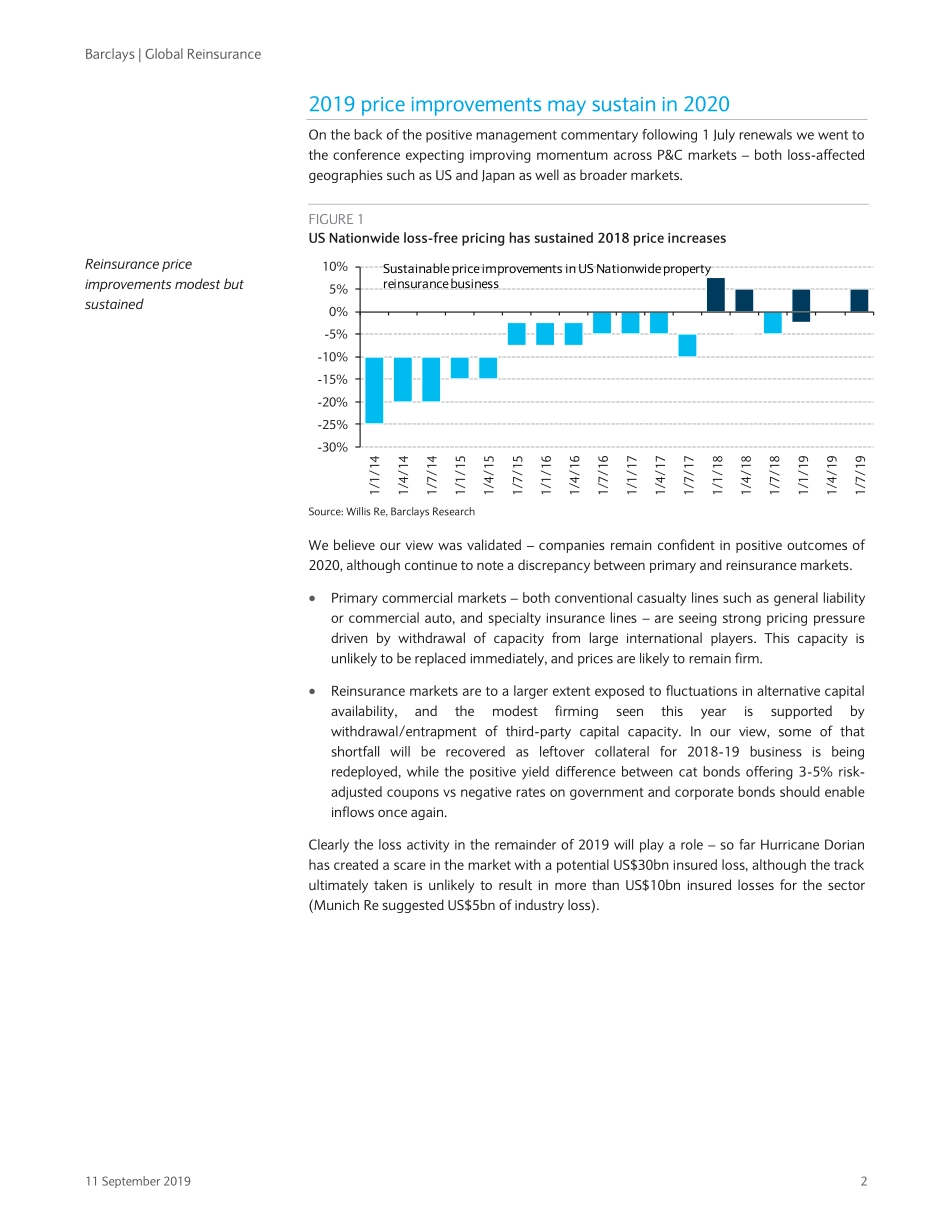

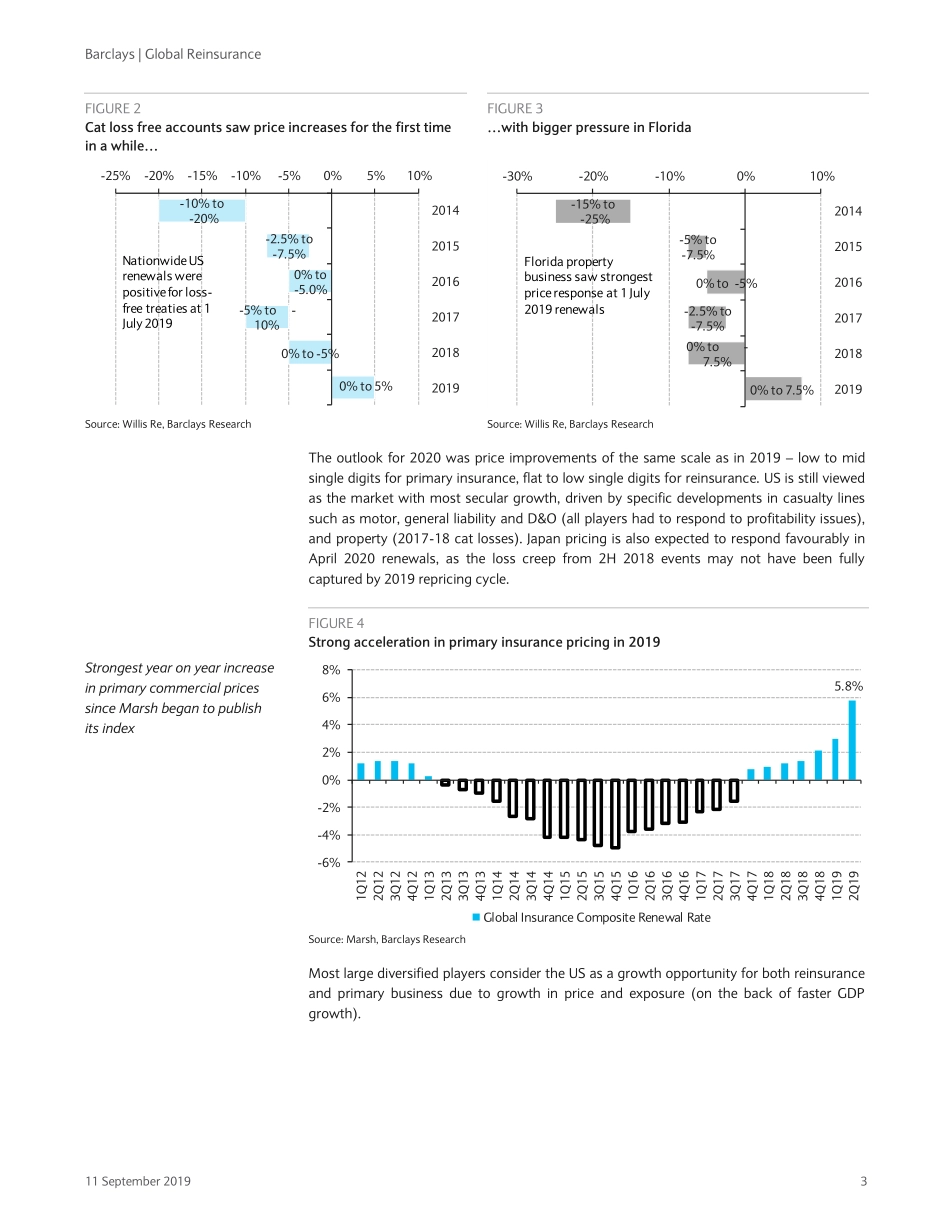

Equity Research 11 September 2019 CORE Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. This research report has been prepared in whole or in part by equity research analysts based outside the US who are not registered/qualified as research analysts with FINRA. PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 16. Restricted - Internal Global Reinsurance Monte-Carlo takeaways: Primary insurers in better position After hosting meetings at the annual reinsurance conference in Monte Carlo with insurers, brokers, credit agencies and consultants, we have come back convinced that, while reinsurance prices are likely to keep modestly increasing on aggregate in 2020, including 1/1 renewals, they are likely to continue to lag primary insurance prices, which are supported by continued re-underwriting actions by major players such as AIG and Lloyd’s. In the meantime, the continued decline of interest rates is a headwind that may only be offset over 1-2 years via new business pricing. We believe that, while the 2019 price improvements may bring combined ratios down by 0.3-1pp, lower investment incomes may offset the benefit to earnings beyond what is already priced in by the market – P&C reinsurers trade approx. 1x standard deviation above historical average on forward P/E and P/BV. We still believe Munich Re (OW) and Swiss Re (OW) should be able to maintain generous capital returns, with total yields of 8-9% that are underpinned by strong balance sheets. AIG’s (OW) turnaround progress and discipline were discussed in almost every meeting, as well as a timely switch towards technical results away from investment margins for AXA (EW) – both companies acknowledge transformation still takes time, but the early results are encouraging. Both prices and margins expected to rise in 2019-20: Insurers and reinsurers expect prices to continue rising in 2020, possibly at the same pace as in 2019, which we see at being low single digits. Much will depend on alternative capital – while there has been a pause in issuance and less price pressure, the asset class is attractive vs the low interest rate backdrop, and inflows should resume in 2020, in our view. Importantly, despite rising loss cost inflation and increased view of risk, reinsurers believe the increases seen this year should support technical margins. Primary insurance prices rise higher, still room to go: Withdrawal of major players like AIG, Lloyd’s, FM Global and Swiss Re CorSo from a number of specialty risks and lines of business has been ...