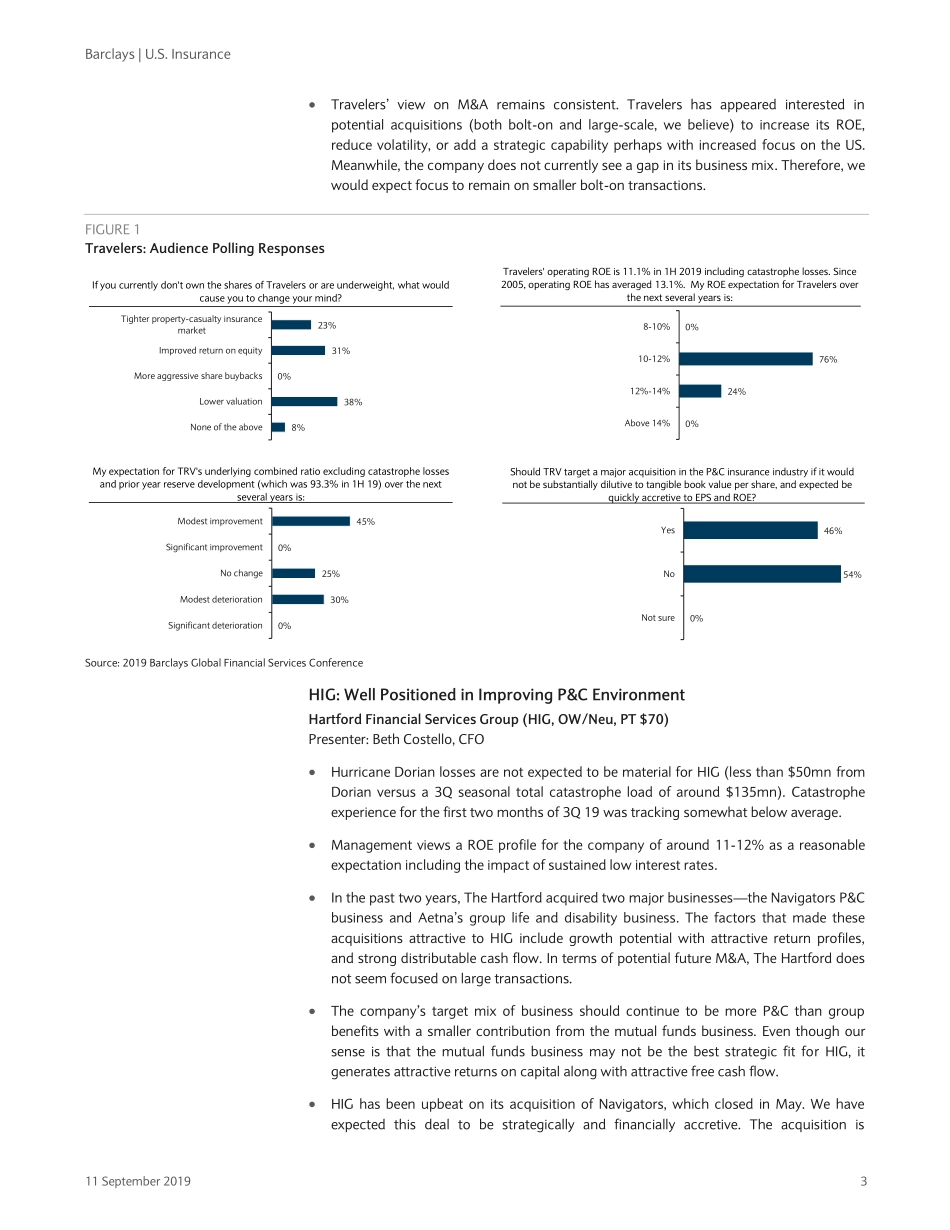

Equity Research 11 September 2019 CORE Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 15. Restricted - Internal U.S. Insurance Takeaways from Insurers at Barclays 2019 Financials Conference Insurance industry presenters at the Barclays Global Financial Services conference on September 9-11: TRV, EQH, HIG, LNC, ACGL, ALL, AIG, UNM. As expected, the outlook was more constructive for the P&C insurers based on favorable pricing trends than for the life insurers, which suffer more from sustained low interest rates. Commercial P&C pricing trends are expected to accelerate in 3Q 19 and Hurricane Dorian insured losses are expected to be modest. TRV sounded a warning about adverse 3Q liability claims trends although other P&C insurers did not. The life insurers did their best to address concerns about the impact on their businesses from sustained low interest rates. P&C insurers benefit from improving commercial P&C and reinsurance pricing and excess capital being returned to shareholders. The major Hurricane Dorian is not expected to result in large-scale (more than $5bn) insured losses. We plan to closely monitor whether other commercial P&C insurers will also suffer from emerging increases in liability claims activity following TRV’s warning; so far, AIG and HIG have not signaled cause for concern. We think P&C valuations have largely taken into account the overall favorable environment, but we expect further gains. Another factor to keep in mind is perhaps less upside to recurring investment income as a result of the recent decline in interest rates. Life insurers face a multitude of headwinds largely related to the most recent drop in interest rates along with a flat yield curve that is expected to place additional downward pressure on investment spreads and overall earnings. Bellwether life insurer valuations have compressed to ~6x 2020E P/E reflecting concerns about the drag on earnings and returns from low rates, and lingering concerns about potential losses from legacy long-term care exposure. At these low valuation levels, perhaps financial buyers will become focused on extracting value in the life insurance industry. P&C Insurer Highlights: TRV said that commercial P&C price increases accelerated during 3Q, but warned that 3Q results would be negatively impacted by worsening liability claims activity. AIG has delivered favorable results in 1H 19, and we expect this trend to continue along with increased efficiency opportunities. ALL has signif...