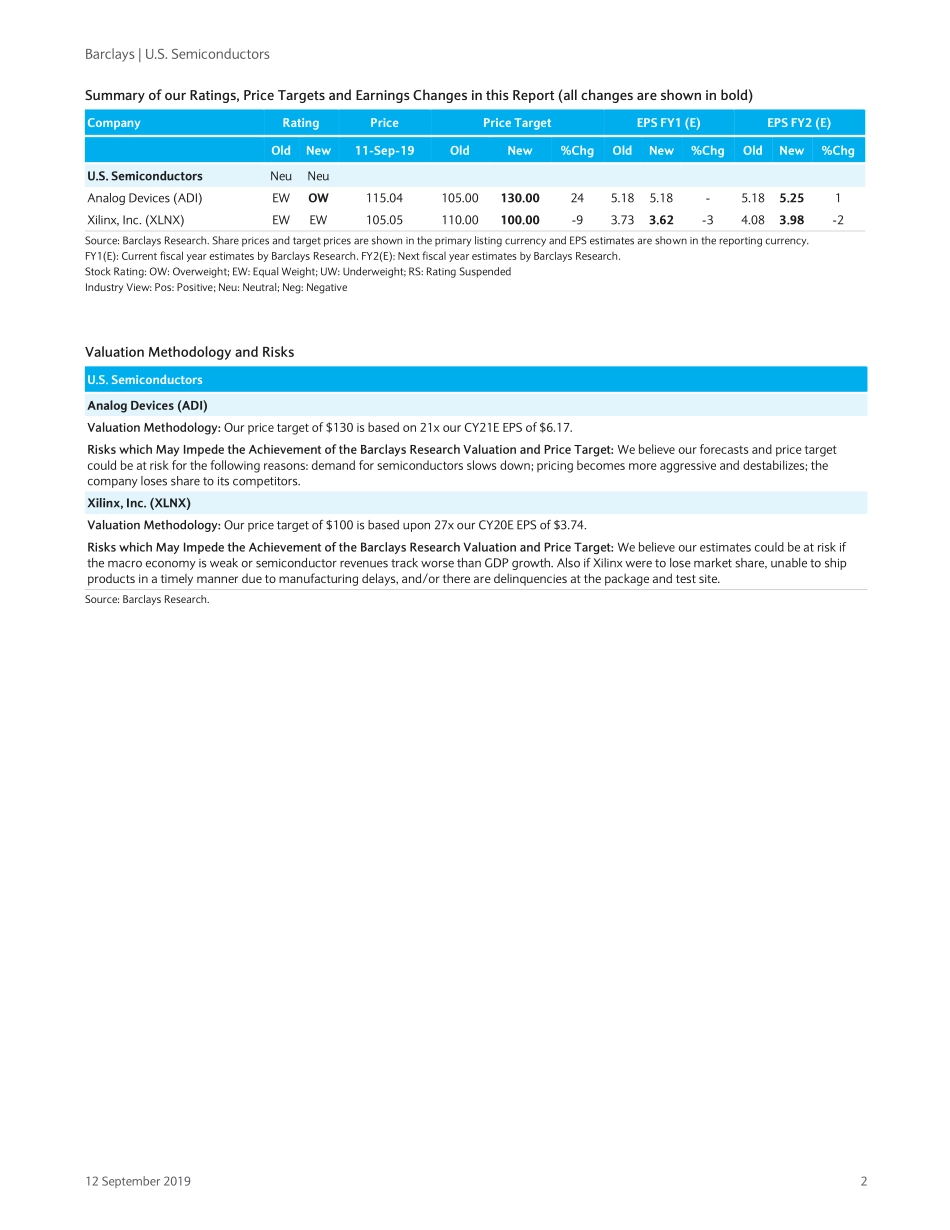

Equity Research 12 September 2019 FOCUS Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. This research report has been prepared in whole or in part by equity research analysts based outside the US who are not registered/qualified as research analysts with FINRA. PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 29. Restricted - Internal U.S. Semiconductors Massive MIMO – Dissecting the Designs and Sizing the Tailwind Massive MIMO is a known trend but in this note we try to dissect just what semiconductors will be used, what potential adoption curves could look like, and ultimately size the opportunity. Unique to this note are teardowns and block diagrams of 5G radio heads as well as forecasts for the semiconductor components benefiting from Massive MIMO and mmWave adoption. In aggregate, we see the Massive MIMO and mmWave silicon opportunity scaling from nearly $3B today to nearly $6B in 2022. Massive MIMO – Increasing Trend as New Spectrum Deployed: Massive MIMO is coming but the debate is when/how operators will incorporate the technology they wait for costs to come down. Korea deployed Massive MIMO widely in its 5G rollout and China should as well but other regions may take a more tempered approach favoring dense/urban environments first. This adds a little volatility into next year depending on China timing/magnitude but we have taken a conservative approach in our market forecasts (~500K vs China alone signaling 1-2M+ in 2020). Regardless of the timing, we see the eventual adoption of Massive MIMO driving semi content higher. Winners from this trend are ADI, TXN, NXPI, and MRVL, while XLNX is more challenged as ASIC use increases. mmWave – Not Ready for Primetime: Regions such as the U.S. are heavily dependent upon the mmWave spectrum for 5G but our work suggests that the technology is not ready from both a performance and cost perspective. What we do know is that when it does happen, the content for semi players in both infrastructure and handset side will be even higher than in sub-6GHz equipment. Winners ADI, NXPI, and MRVL. (ASIC) Upgrade ADI to Overweight – Biggest Massive MIMO Winner: We believe ADI is the clearest winner in Massive MIMO and will look cheap as CY21 (and even CY22) estimates come into focus. In our scenario analysis, we see over $6.00 of earnings power in CY21 (upside case $6.57), implying 18x forward earnings vs analog average of 20-22x forward EPS. ADI’s content (only competition TXN) scales as Massive MIMO drives higher channels per radio...