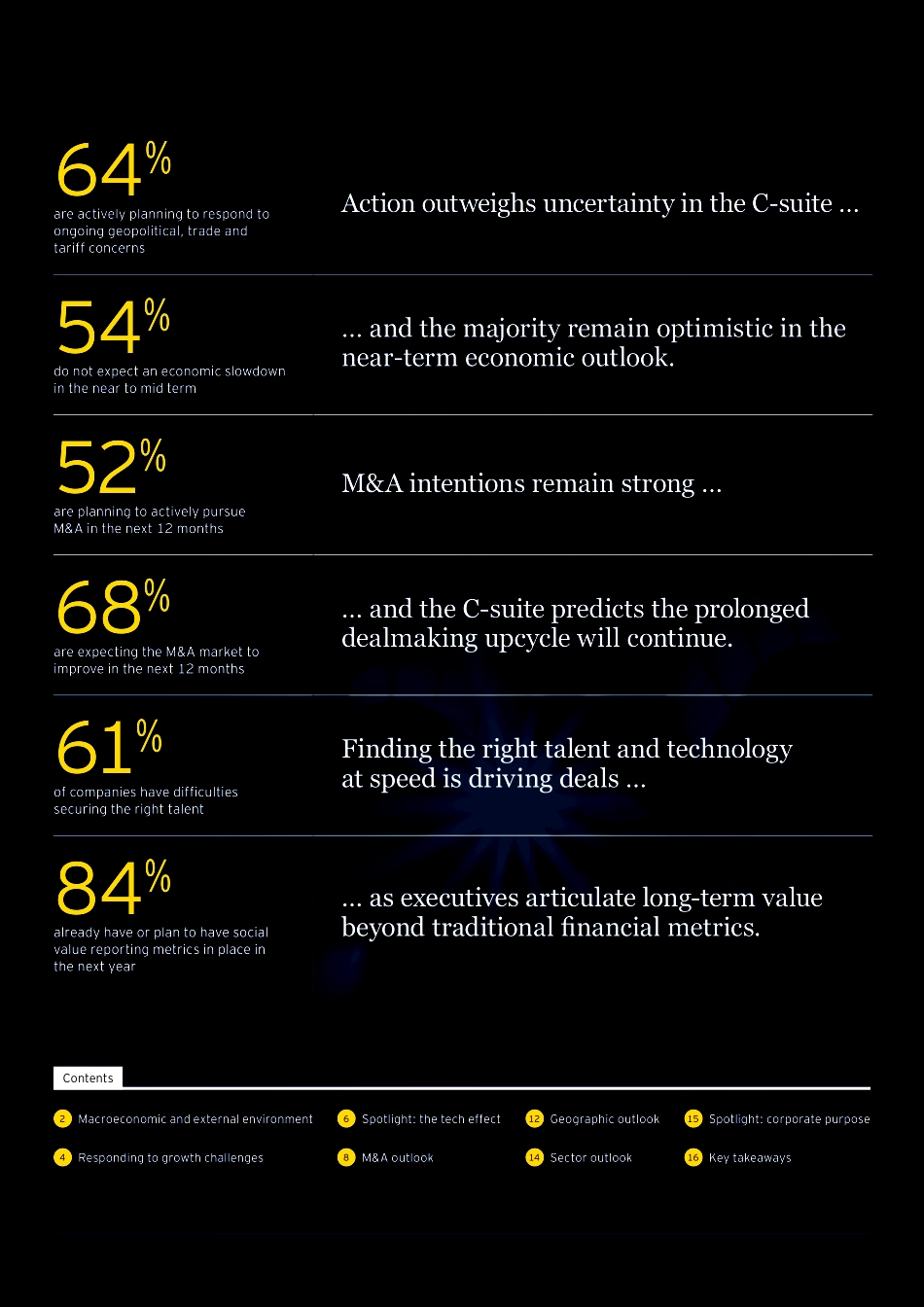

October 2019 | 21st edition | ey.com/CCBGlobal Capital Confidence BarometerM&A — response or resilience?The prolonged upward trend for dealmaking is set to continue despite geopolitical and economic concerns.64%are actively planning to respond to ongoing geopolitical, trade and tariff concernsAction outweighs uncertainty in the C-suite …54%do not expect an economic slowdown in the near to mid term… and the majority remain optimistic in the near-term economic outlook.52%are planning to actively pursue M&A in the next 12 monthsM&A intentions remain strong …68%are expecting the M&A market to improve in the next 12 months… and the C-suite predicts the prolonged dealmaking upcycle will continue.61%of companies have difficulties securing the right talentFinding the right talent and technology at speed is driving deals …84%already have or plan to have social value reporting metrics in place in the next year… as executives articulate long-term value beyond traditional financial metrics. 2 Macroeconomic and external environment4 Responding to growth challenges6 Spotlight: the tech effect8 M&A outlook12 Geographic outlook14 Sector outlook15 Spotlight: corporate purpose16 Key takeawaysContentsGlobal Capital Confidence Barometer | 1Understanding the route to growth: building optionality into strategic decisionsIn today’s environment, it appears that the only certainty is uncertainty. The latest EY Capital Confidence Barometer finds executives dealing with numerous interconnected challenges and proactively managing them.The strategic objective is clear — finding growth. But geopolitical risks, the recasting of trade and tariff rules, zigzagging monetary policy, technology and innovation, as well as evolving regulatory policies, offer obstacles. How best to navigate them?Go for bespoke, not off-the-shelf: not all issues impact each company in the same way. Executives need to continually unlock and assess the impact of challenges — and the possibility of opportunities — for their business portfolio. Be prepared to recast long-held assumptions and follow a tailor-made path to future growth.Keep options open: scenario planning and threat analysis enable business leaders to better highlight risks to current operations. Understanding their own ecosystem, their competitors’ ecosystems and the likely path of innovation will help companies make smart choices about what and when to buy and sell to create the portfolio fit for the future.Buy for tomorrow today: the talent and technology that underpinned growth yesterday is not necessarily best suited to unlock growth tomorrow. With a shortage of technical and digital capabilities, executives need to continually reinvent their talent and technology strategies. In many cases, acquiring will be the fastest way to secure these in-demand assets.Executives are also navigating new societal rules for corporations. Creating long-term value...