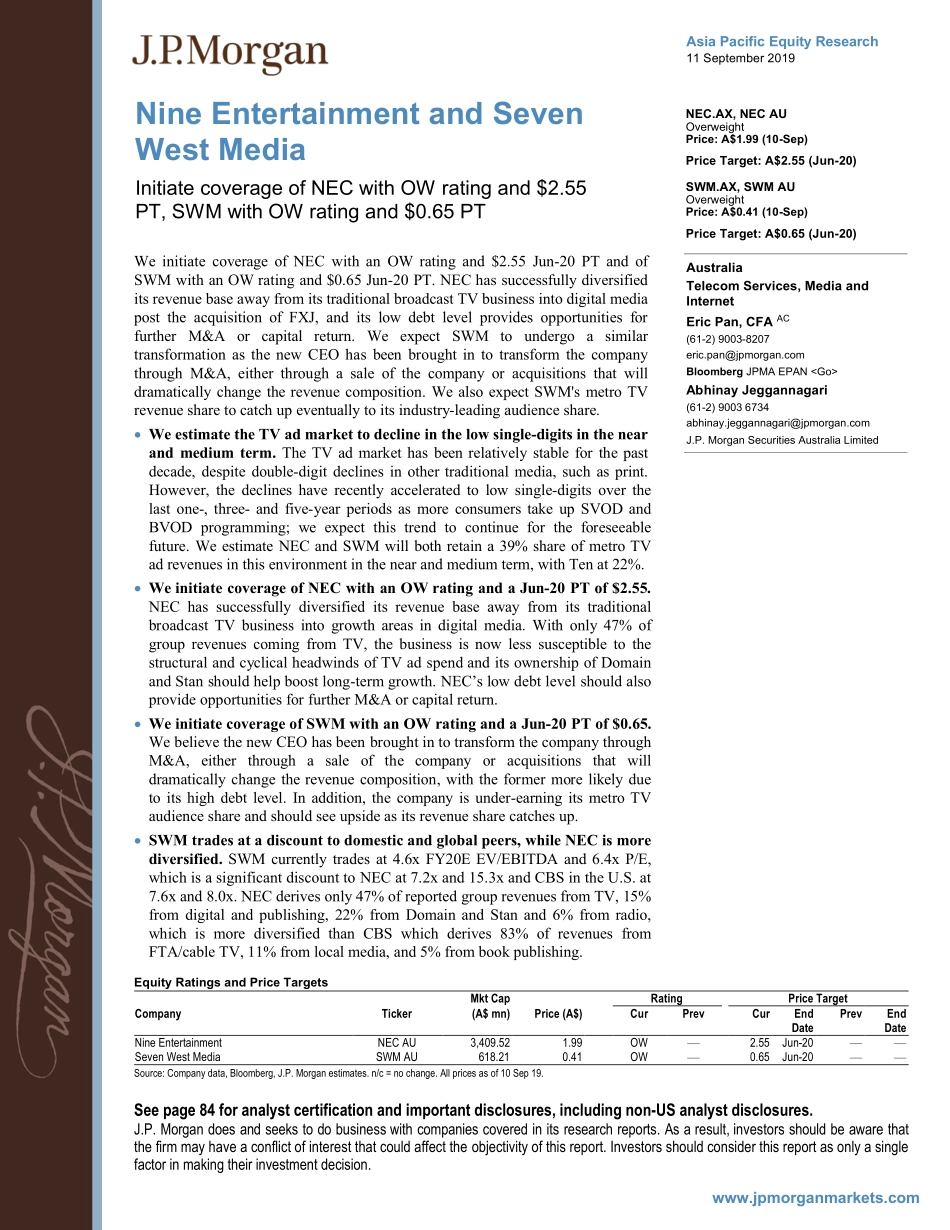

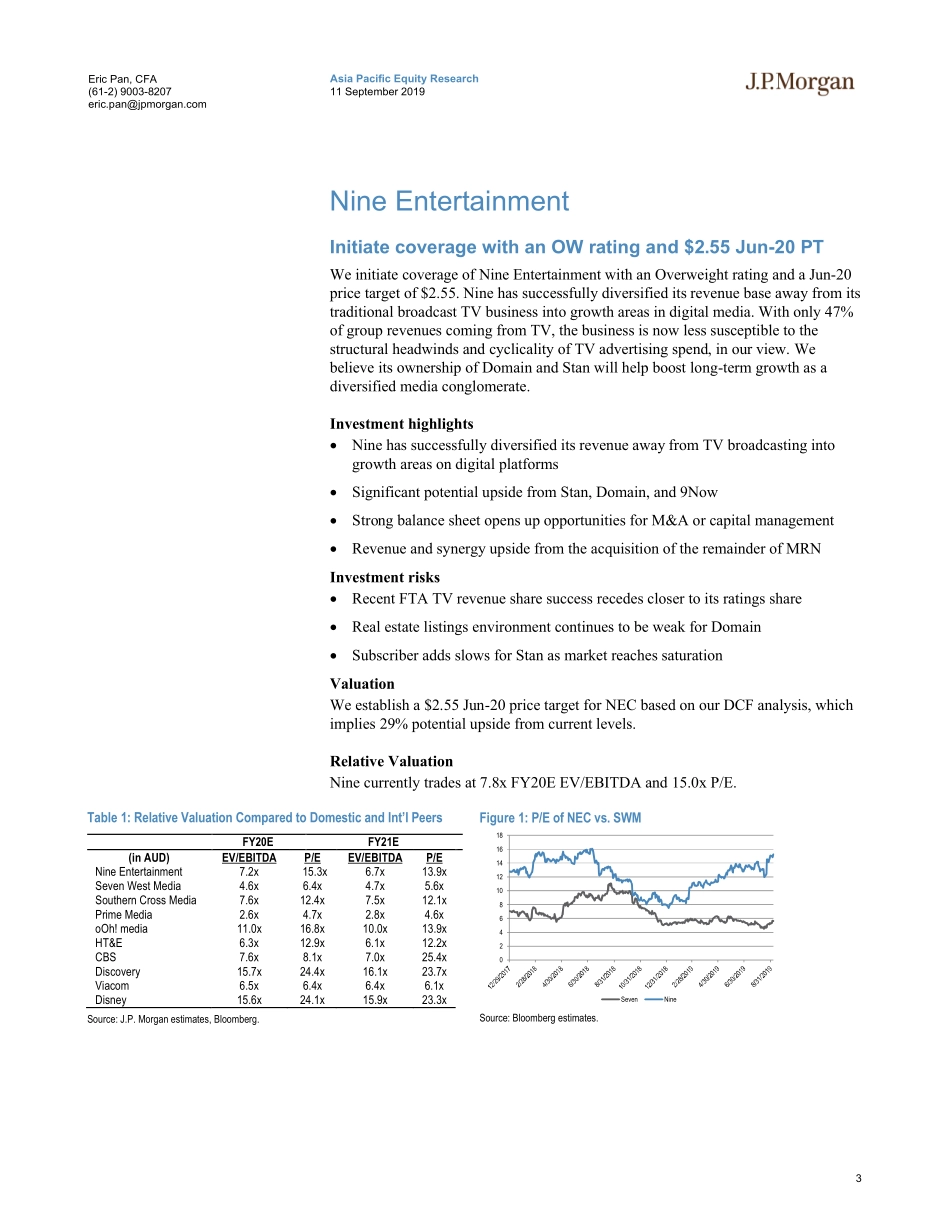

www.jpmorganmarkets.comAsia Pacific Equity Research11 September 2019Nine Entertainment and Seven West MediaNEC.AX, NEC AUOverweightPrice: A$1.99 (10-Sep)Price Target: A$2.55 (Jun-20)Initiate coverage of NEC with OW rating and $2.55 PT, SWM with OW rating and $0.65 PTSWM.AX, SWM AUOverweightPrice: A$0.41 (10-Sep)Price Target: A$0.65 (Jun-20)AustraliaTelecom Services, Media and InternetEric Pan, CFA AC(61-2) 9003-8207eric.pan@jpmorgan.comBloomberg JPMA EPAN Abhinay Jeggannagari(61-2) 9003 6734abhinay.jeggannagari@jpmorgan.comJ.P. Morgan Securities Australia LimitedEquity Ratings and Price TargetsMkt CapRatingPrice TargetCompanyTicker(A$ mn)Price (A$)CurPrevCurEnd DatePrevEnd DateNine EntertainmentNEC AU3,409.521.99OW—2.55Jun-20——Seven West MediaSWM AU618.210.41OW—0.65Jun-20——Source: Company data, Bloomberg, J.P. Morgan estimates. n/c = no change. All prices as of 10 Sep 19.See page 84 for analyst certification and important disclosures, including non-US analyst disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.We initiate coverage of NEC with an OW rating and $2.55 Jun-20 PT and of SWM with an OW rating and $0.65 Jun-20 PT. NEC has successfully diversified its revenue base away from its traditional broadcast TV business into digital media post the acquisition of FXJ, and its low debt level provides opportunities for further M&A or capital return. We expect SWM to undergo a similar transformation as the new CEO has been brought in to transform the company through M&A, either through a sale of the company or acquisitions that will dramatically change the revenue composition. We also expect SWM's metro TV revenue share to catch up eventually to its industry-leading audience share. We estimate the TV ad market to decline in the low single-digits in the near and medium term. The TV ad market has been relatively stable for the past decade, despite double-digit declines in other traditional media, such as print. However, the declines have recently accelerated to low single-digits over the last one-, three- and five-year periods as more consumers take up SVOD and BVOD programming; we expect this trend to continue for the foreseeable future. We estimate NEC and SWM will both retain a 39% share of metro TV ad revenues in this environment in the near and medium term, with Ten at 22%. We initiate coverage of NEC with an OW rating and a Jun-20 PT of $2.55. NEC has successfully diversified its revenue base away from its traditional broadcast TV business into growth areas in digital media. With only 47% of group revenues coming from TV, the business is now less susceptible to...