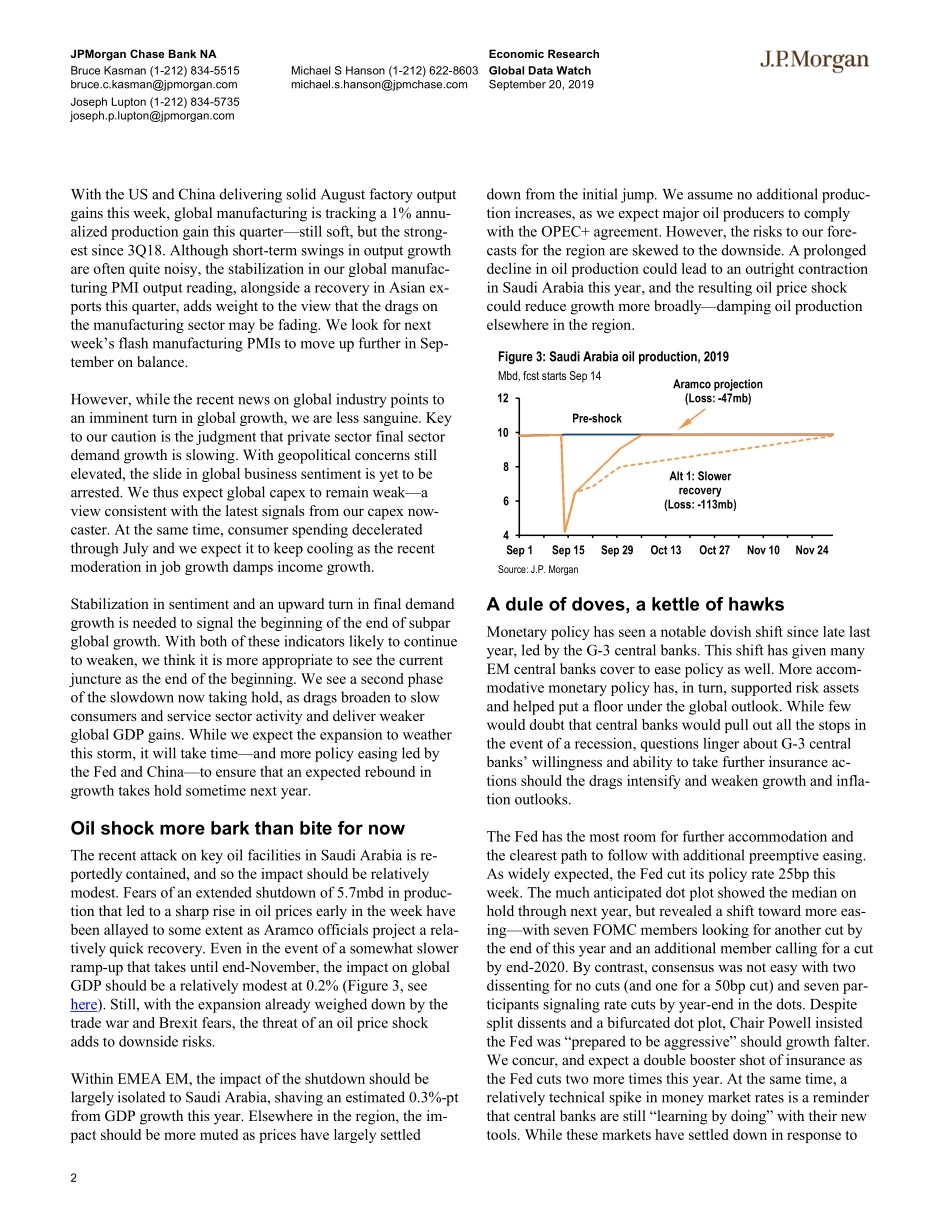

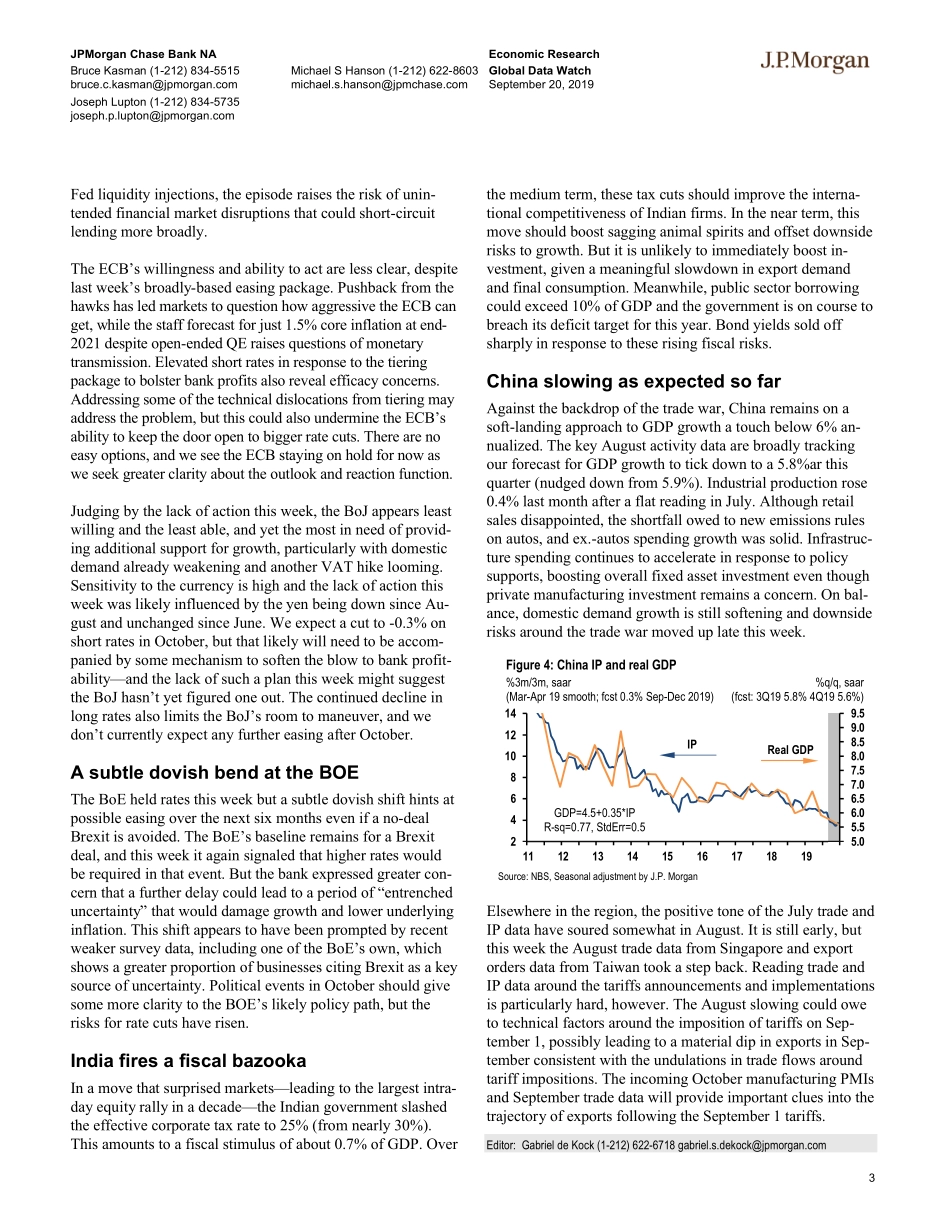

Economic ResearchSeptember 20, 2019Global Data Watch Policy continues to cushion geopolitical drags, but headwinds building Initial fears of oil price shock abated for now, risks not to be ignored Fed delivers; G-3 willingness, ability for further insurance questioned Up next: Sep surveys (G-3 flash PMI, Germany IFO), Banxico -25bp The end of the beginningThe global expansion is caught in a tug-of-war between geopolitical drags and macroeconomic policy supports. The pull of both of these forces was on dis-play this week. Although the single largest geopolitical drag is linked to trade conflicts, nearly all recessions over the past half-century have been preceded by oil price spikes. While last weekend’s attack on Saudi Arabian oil produc-tion will not likely result in the type of price spike that should raise concern, the attack reminds us that an already-sluggish global economy is vulnerable to threats from multiple geopolitical flashpoints. At the same time, a significant monetary policy response has provided an important cushion. Last week’s broad-based easing package from the ECB was followed this week by rate cuts from the Fed and a number of EM central banks. While the BoJ remained on hold, it joined other central banks in tilting its guidance in a dovish direc-tion. Thus far this quarter, we have seen 16 central banks cut rates as the glob-al policy response to the threat from geopolitical drags gathered steam. The tug-of-war between drags and policy helps explain this year’s divergent economic outcomes. Geopolitical drags have weighed heavily on business sentiment, producing a sharp deceleration in global capex and manufacturing output. However, this slowdown has remained largely contained as policy supports have delivered lower borrowing rates and rising equity prices—developments supporting consumer spending and service-sector activity. These divergences had netted out to still-solid, trend-like GDP growth and still-healthy labor market outcomes, thus representing a limited threat to the expansion from geopolitical drags.However, growth dynamics are now shifting in a manner that makes it harder to stay confident that the drags will be contained. Recent reports show a broad slowing in employment growth that suggests the drags are no longer solely concentrated in the goods-producing industries. At the same time, reports from manufacturers suggest the intensity of this year’s drags might be fading.0.51.01.52.0505152535455561214161820DI, sa. Sep forecast boxedFigure 1: Global PMI and employment%3m3m, saarSource: J.P. MorganEmploymentServices PMI-2.0-1.00.01.02.03.04.0-15-10-50510Jan 18Jun 18Dec 18Jun 19%3m, saar; both scales.Figure 2: Manufacturing outputSource: J.P. MorganEMAX(thru Jul)US(thru Aug)Global(w/ Aug tracking)ContentsOil supply shock hits already fragile global economy16US: Digging into the gap between CPI and PCE inflation18Argentin...