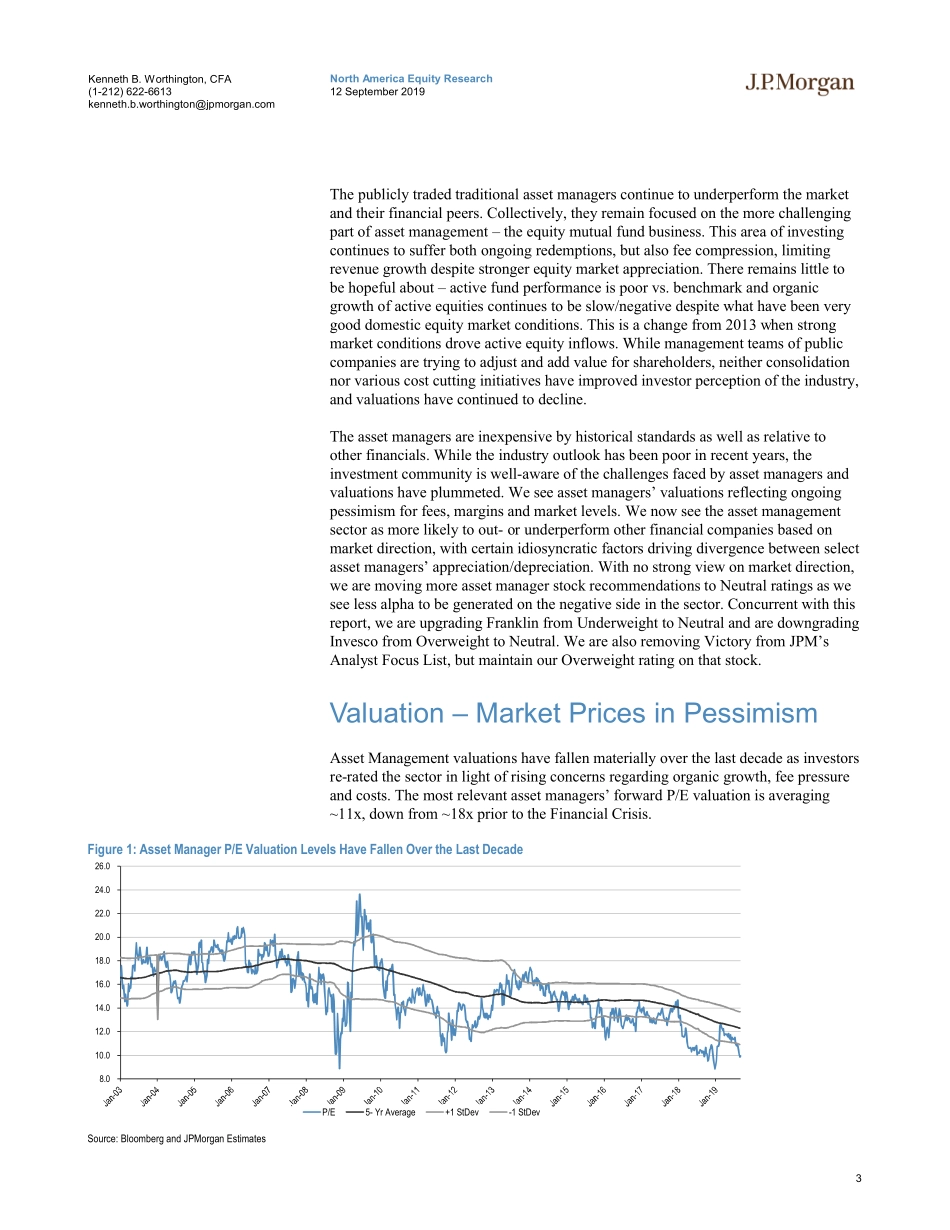

www.jpmorganmarkets.comNorth America Equity Research12 September 2019Equity Ratings and Price TargetsMkt CapPriceRatingPrice TargetCompanyTicker($ mn)CCYPriceCurPrevCurEnd DatePrev End DateBlackRockBLK US69,677.39USD432.83OWn/c525.00Dec-20n/cn/cEaton Vance CorpEV US5,340.00USD46.74UWn/c42.00Dec-20n/cn/cFederated Investors, Inc.FII US3,233.48USD33.27OWn/c42.00Dec-20n/cn/cFranklin ResourcesBEN US14,787.17USD29.48NUW32.00Dec-20n/cn/cInvesco Ltd.IVZ US7,583.21USD17.57NOW22.00Dec-20n/cn/cJanus HendersonJHG US4,274.54USD21.82Nn/c23.00Dec-20n/cn/cJanus Henderson Group plcJHG AU4,140.83AUD30.81Nn/c33.00Dec-20n/cn/cT. Rowe Price Group, IncTROW US29,133.83USD120.09UWn/c114.00Dec-20n/cn/cVictory CapitalVCTR US1,137.73USD16.85OWn/c22.00Dec-20n/cn/cSource: Company data, Bloomberg, J.P. Morgan estimates. n/c = no change. All prices as of 11 Sep 19.US Asset ManagersAdjusting Asset Manager Positioning -- Moving BEN and IVZ to Neutral; Removing VCTR from Focus ListBrokers, Asset Managers & ExchangesKenneth B. Worthington, CFA AC(1-212) 622-6613kenneth.b.worthington@jpmorgan.comBloomberg JPMA WORTHINGTON William V. Cuddy, CFA(1-212) 622-6454william.v.cuddy@jpmorgan.comJenny Ni(1-212) 622-6495jenny.ni@jpmorgan.comJ.P. Morgan Securities LLCSee page 39 for analyst certification and important disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.We see the traditional asset managers as having grown particularly inexpensive. Valuations have contracted from ~18x prior to the Financial Crisis to ~11x today. Investors have recognized various challenges faced by traditional asset managers and have driven a steep re-rating of the sector. Based on a DCF, we feel that investors have priced in many risks. While we don’t see catalysts for the sector to move higher, apart from particularly strong equity markets from here, we think it challenging for valuations to drop further unless outflows were to accelerate. We therefore move more of our ratings to Neutral and await more idiosyncratic rationale for Overweight and Underweight recommendations. Asset Mgmt trends remain unchanged – mix to passive, fee pressure and margins stall. We see the traditional asset management business remaining under pressure. Performance of active equity products generally remains below benchmark and the transition to passive continues. As a result we are seeing direct and indirect pressure on fees. Despite much higher US equity markets, lower fee rates are putting pressure on margins, driving margin expansion to stall, when normally under strong equity market conditions they would be expanding. Valuations suggest much risk is priced. Valuations in the asset mgmt. sector are at historic lo...