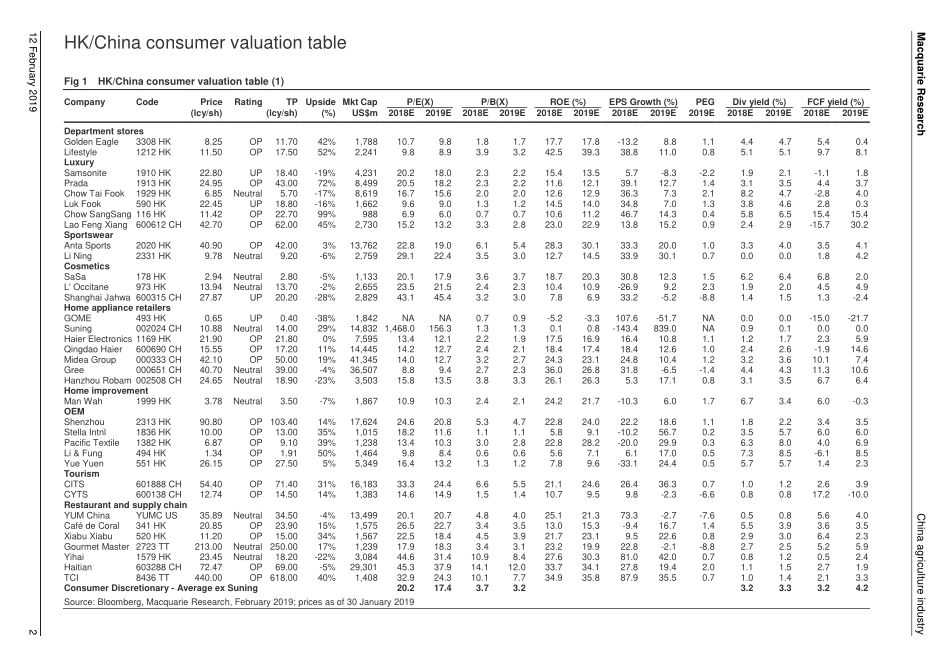

Please refer to page 57 for important disclosures and analyst certification, or on our website www.macquarie.com/research/disclosures. 12 February 2019 Greater China EQUITIES Inside HK/China consumer valuation table 2 Hog price poised to rally in 2H19; ASF will intensify this hog cycle 4 Broiler prices remains high due to supply shortage 16 Feed outlook: mild growth of corn prices, uncertain soymeal prices 21 Appendices – terminology of hog industry 24 WH Group/Shuanghui – Prefer WH to Shuanghui 25 Yum China Holdings 28 MacVisit: Fujian Sunner 32 MacVisit: Wens Foodstuff 37 MacVisit: Muyuan Foodstuff 41 MacVisit: New Hope Liuhe 45 MacVisit: COFCO Meat 48 MacVisit: Guangdong Haid 53 Analysts Macquarie Capital Limited Linda Huang, CFA +852 3922 4068 linda.huang@macquarie.com Terence Chang +852 3922 3581 terence.chang@macquarie.com Sunny Chow +852 3922 3768 sunny.chow@macquarie.com Cici Yu +86 21 2412 9078 cici.yu@macquarie.com Hugo Shen +86 21 2412 9077 hugo.shen@macquarie.com China agriculture industry A fruitful pig year Key points Hog prices poised to rally in 2H19; ASF will intensify this hog cycle. Broiler prices to remain high due to short supply. Feed outlook: mild growth of corn prices, uncertain soybean meal prices. We visited six listed companies in the field of agriculture recently and thus provide our 2019 outlook for China’s agriculture industry. Based on Macquarie’s supply & demand model, we believe hog prices are well poised for a rally in 2H19 and that broiler prices will remain high, due to tight supply. On the back of little pressure from feed costs, we believe 2019 will be a fruitful Year of the Pig for hog and broiler producers in China. Hog price poised to rally in 2H19; ASF will intensify this hog cycle The National Bureau of Statistics announced a reported 8.3% YoY decrease in sow stock at the end of 2018. Our industry checks with feed producers nationwide indicated a more severe decline at ~10% YoY. In addition to the ongoing Africa Swine Fever (ASF) preventing restocking, we estimate an 8.1% decrease in total supply and 3.6m-ton shortage if assumed 2% demand decline. Based on our sensitivity analysis, each 1% growth on the demand side will lead to a 0.55m-ton pork supply shortage. We believe pork prices will bottom in 2Q19, then pick up in 2H19. Moreover, we think the ongoing ASF will last for a long time, which will intensify and prolong this hog cycle. Broiler price remains high due to supply shortage China’s white-feathered boiler production relies mainly on imported grandparents. Given the lingering shortage of imported grandparent stock, Macquarie broiler supply and demand model projects a 3% increase of supply in 2019. On the demand side, we believe consumption will also pick up slightly, with 3% YoY growth in 2019 due to concerns on ASF and the substitution effect of pork as...