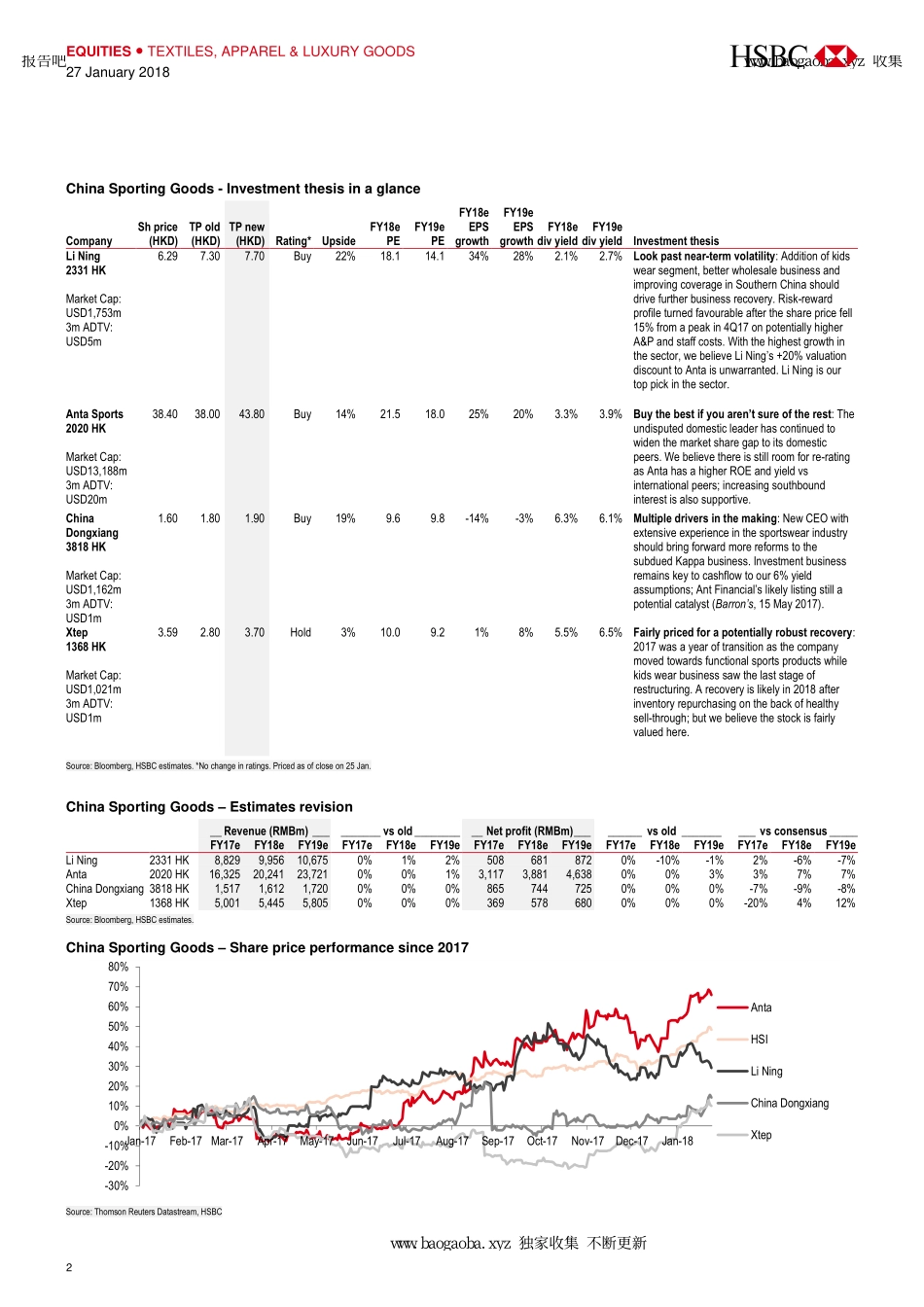

报告吧www. baogaoba. xyz 收集 www. baogaoba. xyz 独家收集 不断更新 Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: The Hongkong and Shanghai Banking Corporation Limited View HSBC Global Research at: https://www.research.hsbc.com MiFID II – ResearchIs your access agreed?CONTACT us today We highlight three key sector developments in 2017 A warm welcome to a cold winter: favourable weather condition should boost sector 4Q17 retail sales We see best risk-reward profile in Li Ning (Buy) 2017 was an eventful year. While the China Sporting Goods sector continued to grow at a healthy and steady pace at around two times GDP growth, there were a lot of changes that the number does not tell. We highlight three key themes: 1) Chinese shifting preference in both shoes and stocks: these are indicated by changes in the top five brands by market share and southbound liquidity flow; 2) channel, products, and brand equity drive consolidation: smaller regional players continued to exit the business and while this is an opportunity for other domestic brands, improving customer experience remains key to garner market share; and 3) privatisation of Belle and Pou Sheng points to a need for change: while the two biggest distributors of international brands should benefit from strong top-line momentum, the challenges they faced are a key lesson for all retailers. It’s freezing! We believe a colder-than-expected winter has boosted retail sell-through of the sector during 4Q17, which is supported by retail data reported by Pou Sheng (3813 HK, not rated) and Xtep. For Pou Sheng, 4Q sales accelerated to 20% yoy from 13% in 3Q, whereas domestic brand peer Xtep also saw faster same-store-sales growth (SSSG). For 4Q, we expect Anta’s brand retail sales growth to reach +20% yoy (from mid-teens in 3Q) thanks in part to a successful 11.11 online event promotions. For Li Ning, we forecast an acceleration to high single-digit growth (from low single-digit growth in 3Q). Switch preference from Anta to Li Ning. We see the best risk-reward profile in Li Ning and raise our TP to HKD7.70 (from HKD7.30) after rolling over our valuation from FY18 to FY18-19e, which is partially offset by lower earnings; reiterate Buy. We think the recent share price correction has more than priced in potentially higher opex. Despite having the highest earnings growth in the sector, Li Ning is trading at >20% discount on FY19e PE to Anta. We maintain a Buy and increase our TP for Anta to HKD43.80 (from HKD38.00) from a combination of higher FY19e estimates, higher multiples, and valuation roll-forward. We are 7% ahead of consensus net profit as we see stronger top-line growth. We rate Dongxiang a Buy given po...