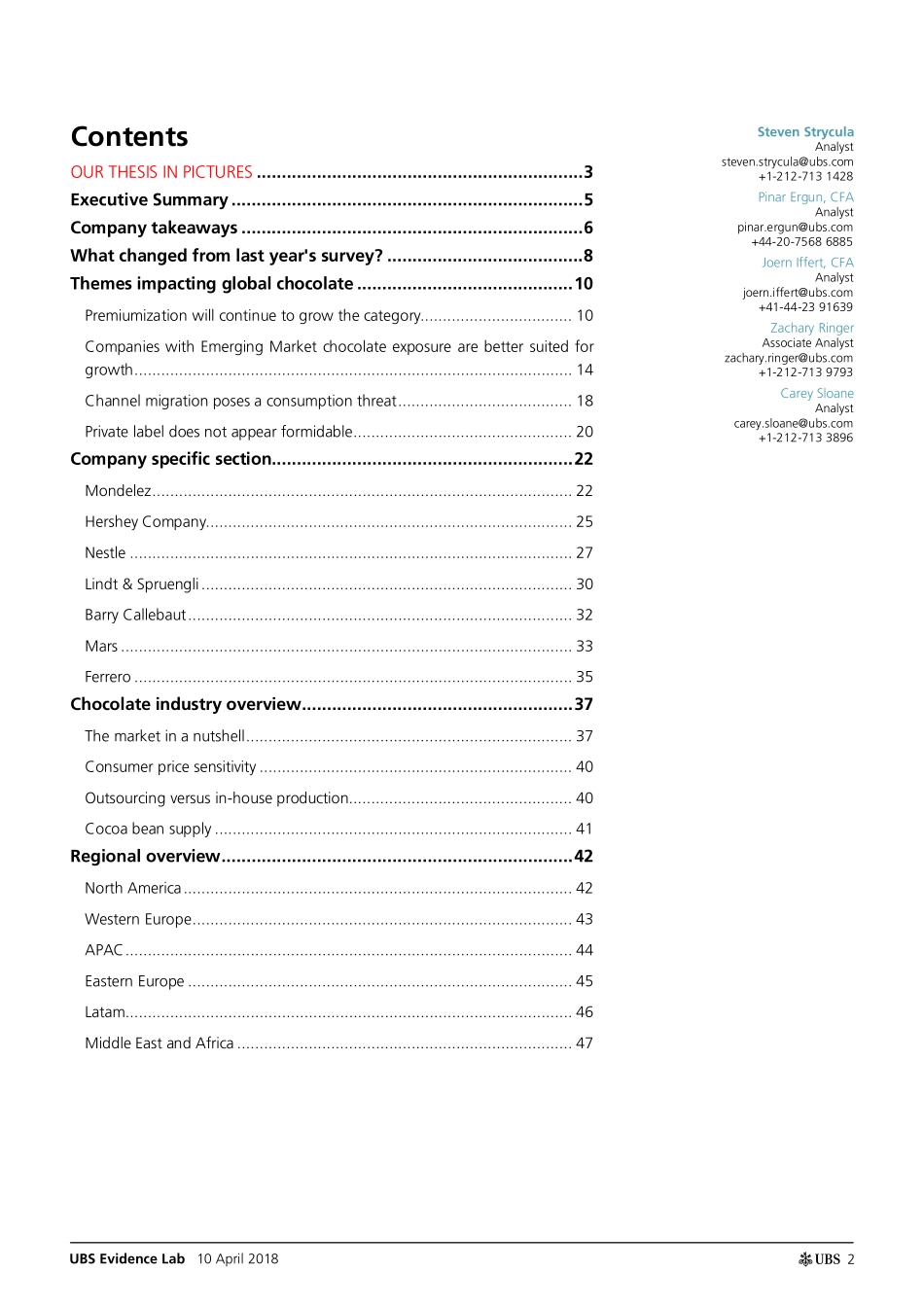

www.ubs.com/investmentresearch This report has been prepared by UBS Securities LLC. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 49. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 10 April 2018 UBS Evidence Lab Chocolate Competition Poised to Intensify in 2018 Key findings from 2nd Annual Global Chocolate Report In our 2nd annual survey of 4,100 consumers we partnered with UBS Evidence Lab to analyze category drivers and consumer brand preferences in the USD$102 billion global chocolate confectionary market. Our key conclusions are: (1) consumers in developed markets are eating chocolate less frequently in place of healthier snacking alternatives; (2) chocolate consumption (HH penetration) in emerging regions continues to rise; (3) premium chocolate brand revenue growth is outpacing mainstream brands; and 4) chocolate confection, often an impulse occasion purchase, is unfavorably exposed to the secular shift to online grocery away from in-store snack purchasing. Developed mkt consumption is pressured but emerging markets offer growth Per UBS Evidence Lab, survey respondents claim their chocolate consumption frequency declined -1% in the last 12 months. Slowing consumption trends reflects the chocolate category's decreased share of wallet in mature markets and reduced usage occasion vs healthier snacking alternatives. Conversely, consumption in emerging market countries (Brazil, China, India) continues to rise, led by increased household penetration. Further, we believe chocolate industry margin gains are poised to slow, with an unfavorable inflection in commodity inputs such as cocoa (+30% YTD). As favorable cocoa hedges roll-over in 2019 and 2020 we expect gross margin pressure will elevate. Stock calls: Buy Mondelez and Lindt. Sell Hershey and Barry Callebaut. Within our coverage of chocolate related stocks, we identify portfolios with exposure to emerging markets (Mondelez, Buy) and premium brands (Lindt & Sprüngli, Buy) as best positioned. Mondelez also enjoys 'white space' from recently entering two of the world's largest chocolate markets, US and China, where it is likely to take share from incumbents such as Hershey and Mars. We highlight companies with outsized exposure to mainstream chocolate and developed economies, such as Hershey (Sell) and Barry (Sell), as least advantaged due to decelerating end-markets. Figure 1: Global Chocolate Exposure Chocolate as % of Type of chocolate, US Regional exposure in chocolate category Favored Rating total sales Premium Standard Developed markets Emerging markets Mondelez Most Buy 31% 19% 81% 59% 41% L...