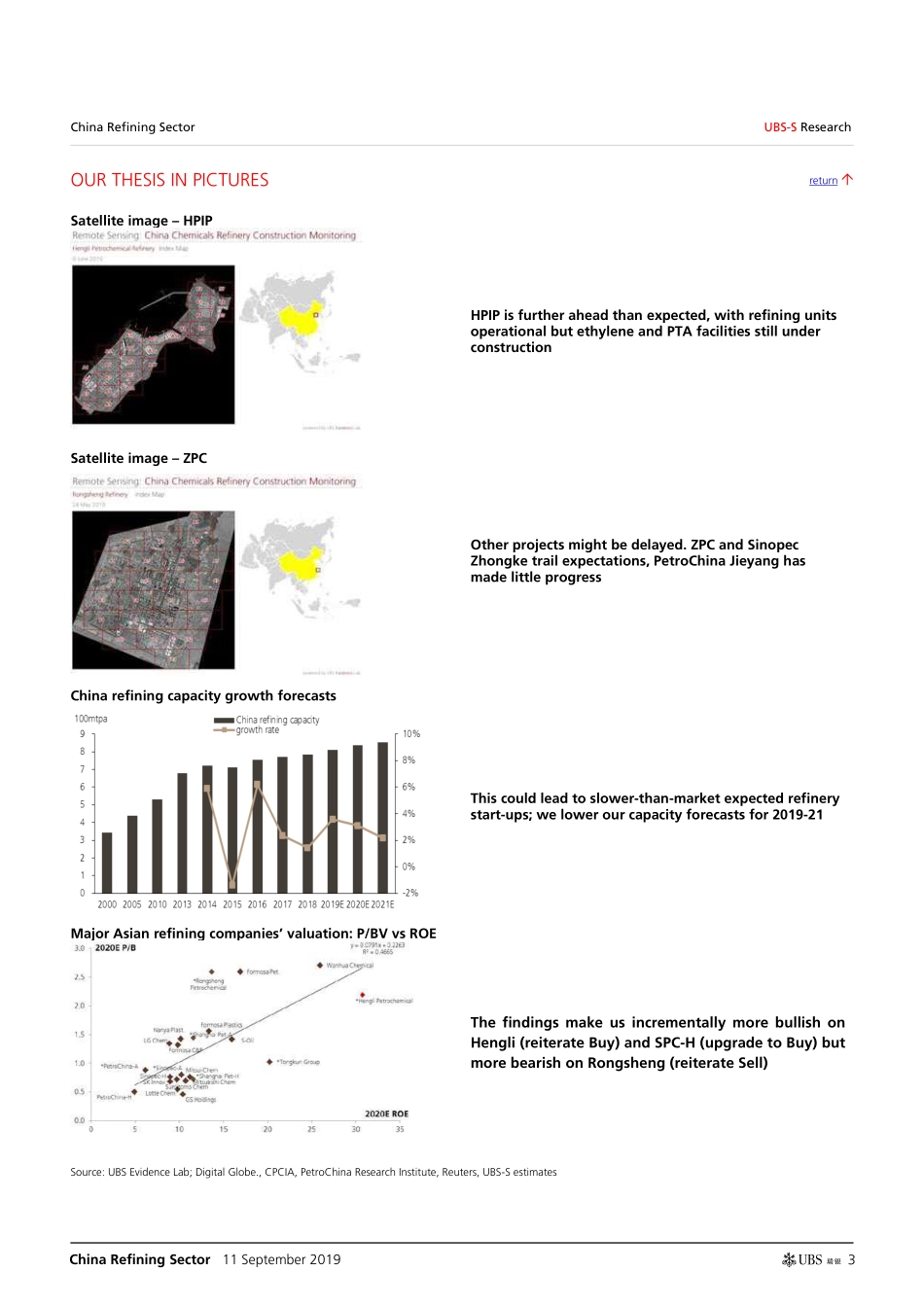

www.ubssecurities.com This report has been prepared by UBS Securities Co. Limited. This is a translation of a Chinese research note published by UBS Securities Co Ltd on 11 September 2019. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 51. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. abc Global Research 11 September 2019 China Refining Sector UBS Evidence Lab inside: satellite imagery indicates slower refining capacity growth in China China's mega refineries launch slower than expected Contrary to the market's view, we think China's refining fundamentals could stabilise due to a combination of slower-than-expected progress of refining projects and IMO 2020. To better gauge the construction progress of four mega refineries in China, UBS Evidence Lab uses satellite imagery, and the findings indicate that apart from Hengli Petrochemical Industrial Park's (HPIP) which is ahead of expectation, the refineries of the others—Zhejiang Petrochemical (ZPC, 51% owned by Rongsheng, 20% owned by Tongkun), Zhongke Refinery (Sinopec) and Jieyang Refinery (PetroChina)—trailing expectations. The findings make us more bullish on Hengli and SPC-H (upgrade to Buy) but more bearish on Rongsheng. We expect ZPC launch to be delayed; Zhongke and Jieyang at early stage We use UBS Evidence Lab's Remote Sensing practice suite's satellite imagery with its cutting-edge image recognition and data processing technique to assess each refinery's construction progress. As of the tracking date: 1) HPIP's refinery facilities were on stream, with ethylene/PTA facilities under construction. 2) ZPC's Phase I refining and chemical units were still not completed and progress overall trailed expectations—we now expect start-up in H220 instead of the end-2019 target. 3) Construction of Sinopec's Zhongke has begun and will likely come online in 2021-22E (guided for late-2019). 4) Little progress to date at PetroChina's Jieyang Nanhai Refinery and start-up might be delayed to 2022 (2021 target). Lagging mega projects could help refining fundamentals stabilise in China Based on UBS Evidence Lab data, we lower our capacity addition estimates for 2019/2020/2021 to 560/500/320Kb/d (down from 680/700Kb/d in 2019E/2020E), implying 3% annual growth, which is generally in line with consumption growth. Hence, oversupply of refined oil products might not be as severe as expected. Also, IMO regulations are likely to support APAC/China refiners. Actual demand for China oil products might not be as weak as National Bureau of Statistics data suggests. Raise Hengli PT (Buy); lower Rongsheng PT (Sell); upgrade SPC-H to Bu...