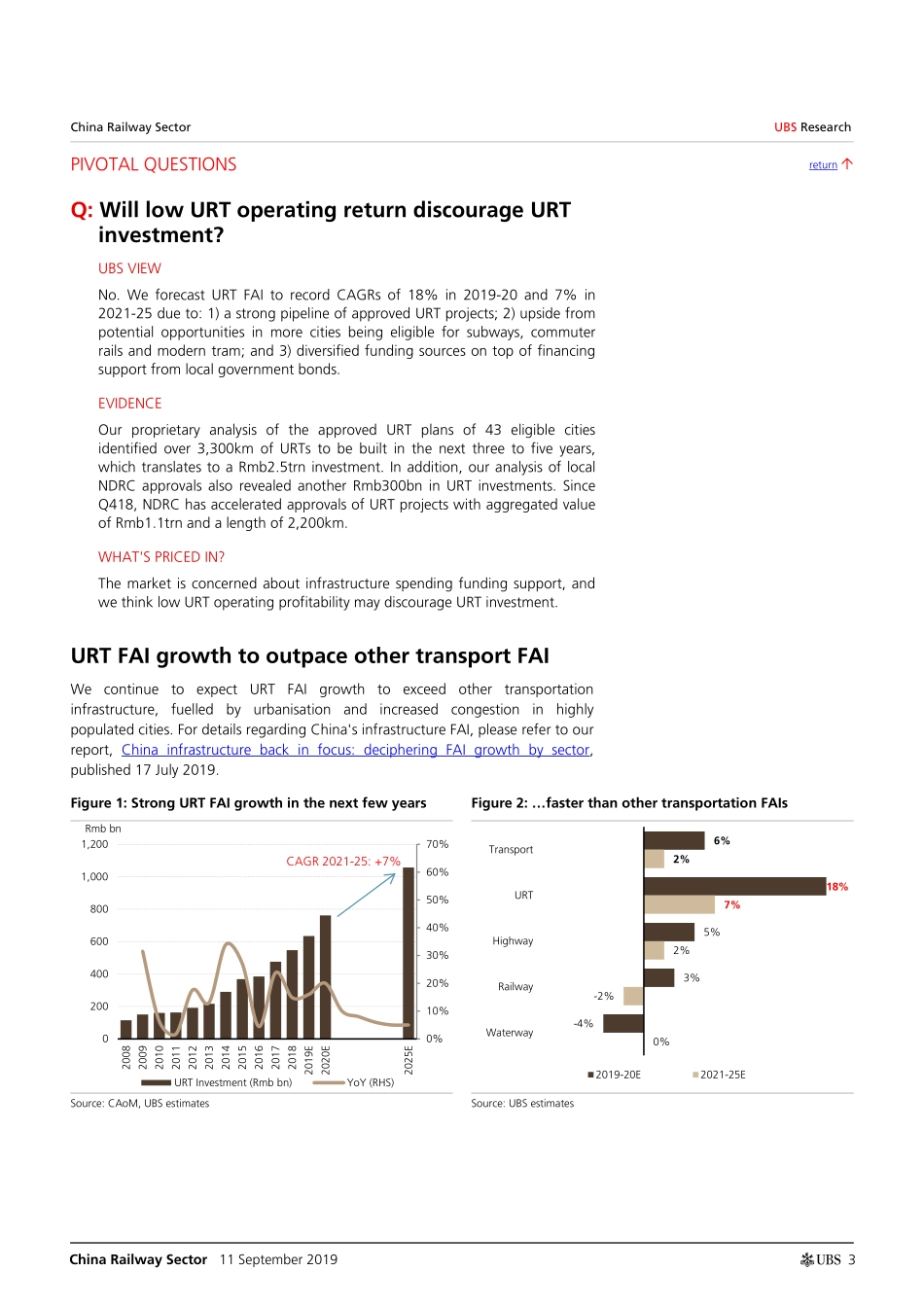

www.ubs.com/investmentresearch This report has been prepared by UBS Securities Asia Limited. ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 21. UBS does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Global Research 11 September 2019 China Railway Sector China Railway In-depth Series #5: Will low URT operating return discourage URT investment? URT to deliver faster FAI growth than other transportation infrastructure We remain positive on the infrastructure FAI growth recovery in H219-2020E and consider urban rail transit (URT) investment as a key growth driver. We provided a detailed analysis of the economic and social benefits despite low financial returns of railways in China Railway In-Depth Series #4. We think this applies to China's URT system as well, as it also suffers from significant operating losses. We believe commercial land development around URT stations provides additional funding support on top of government financing, with evidence from our case study of URTs in Shenzhen and Hong Kong. We believe construction companies, design companies and railway equipment makers are key beneficiaries of rising URT FAI. What is driving the URT investment recovery? We project URT FAI to deliver CAGRs of 18% in 2019-20 and 7% in 2021-25 due to: 1) a strong pipeline of approved projects; 2) upside from more cities becoming eligiblefor subways, light rail, commuter rail and modern trams; and 3) diversified fundingsources in addition to local government funding. Based on our proprietary analysis onthe National Development and Reform Commission’s (NDRC) approved URT plans for43 eligible cities, we expect over 3,300km of URTs to be built in the next three to fiveyears, translating to a Rmb2.5trn investment. Besides subway, we found roughlyRmb300bn of other forms of URT approvals from local NDRCs.Identifying potential beneficiaries of the URT investment recovery China's URT market is highly concentrated. In recent years: 1) leading URT designer Beijing Urban has a 25% market share and 90% of its profit coming from URT; 2) CRCC and CRG together occupy 65%/50% of URT construction/design markets, but we estimate the overall profit contribution to be 16-18%; 3) tunnel boring machines and signalling systems are early-cycle beneficiaries within equipment; we prefer CRSC with a 40% industry market share and 21% of profit from URT; and 4) CRRC has a 90% market share of rolling stock and profit from URT is 13%; Zhuzhou has 50% of the traction system market share, and profit from URT is 20%. UBS’s key recommendations We like Beijing Urban in the URT design market; CRC...