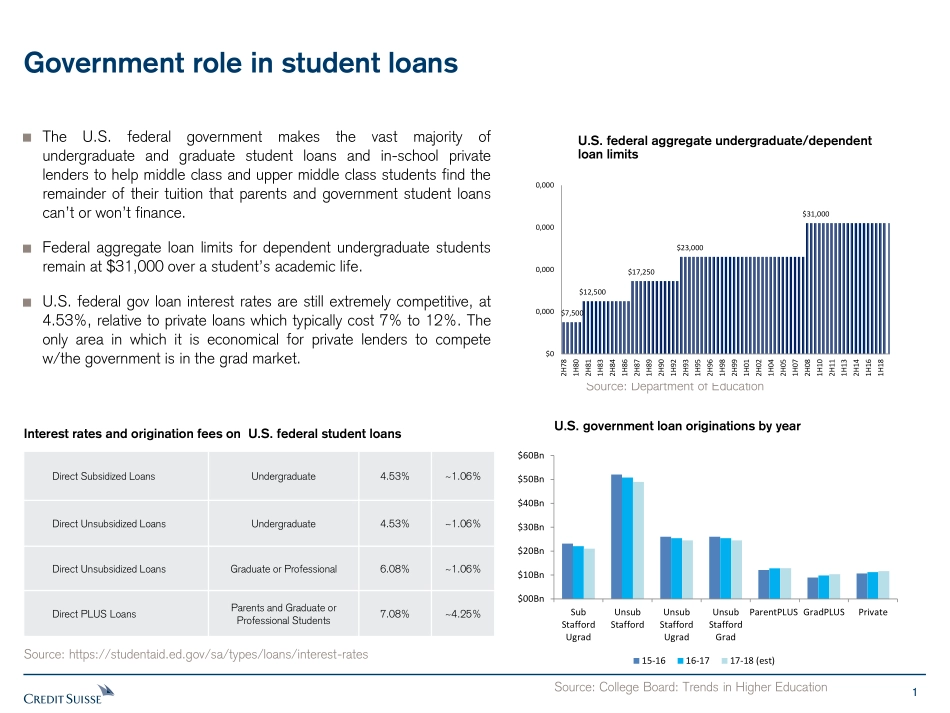

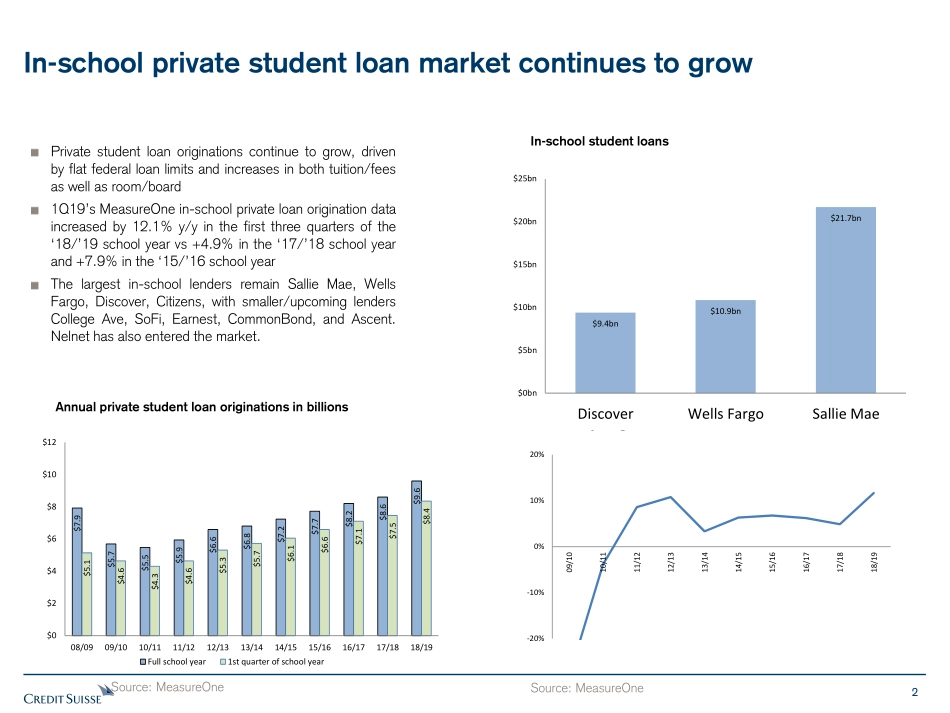

Student Loan Outlook September 2019 DISCLOSURE APPENDIX AT THE BACK OF THIS REPORT CONTAINS IMPORTANT DISCLOSURES, ANALYST CERTIFICATIONS, LEGAL ENTITY DISCLOSURE AND THE STATUS OF NON-US ANALYSTS. US Disclosure: Credit Suisse does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the Firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. James Ulan 212 325 8235 james.ulan@credit-suisse.com Moshe Orenbuch 212 538 6795 moshe.orenbuch@credit-suisse.com 1 The U.S. federal government makes the vast majority of undergraduate and graduate student loans and in-school private lenders to help middle class and upper middle class students find the remainder of their tuition that parents and government student loans can’t or won’t finance. Federal aggregate loan limits for dependent undergraduate students remain at $31,000 over a student’s academic life. U.S. federal gov loan interest rates are still extremely competitive, at 4.53%, relative to private loans which typically cost 7% to 12%. The only area in which it is economical for private lenders to compete w/the government is in the grad market. U.S. federal aggregate undergraduate/dependent loan limits Government role in student loans U.S. government loan originations by year Source: College Board: Trends in Higher Education Source: Department of Education Source: https://studentaid.ed.gov/sa/types/loans/interest-rates Interest rates and origination fees on U.S. federal student loans Direct Subsidized Loans Undergraduate 4.53% ~1.06% Direct Unsubsidized Loans Undergraduate 4.53% ~1.06% Direct Unsubsidized Loans Graduate or Professional 6.08% ~1.06% Direct PLUS Loans Parents and Graduate or Professional Students 7.08% ~4.25% $7,500$12,500$17,250$23,000$31,000$0$10,000$20,000$30,000$40,0002H781H802H811H832H841H862H871H892H901H922H931H952H961H982H991H012H021H042H051H072H081H102H111H132H141H161H182H19$00Bn$10Bn$20Bn$30Bn$40Bn$50Bn$60BnSubStaffordUgradUnsubStaffordUnsubStaffordUgradUnsubStaffordGradParentPLUS GradPLUSPrivate15-1616-1717-18 (est)2 Private student loan originations continue to grow, driven by flat federal loan limits and increases in both tuition/fees as well as room/board 1Q19’s MeasureOne in-school private loan origination data increased by 12.1% y/y in the first three quarters of the ‘18/’19 school year vs +4.9% in the ‘17/’18 school year and +7.9% in the ‘15/’16 school year The largest in-school lenders remain Sallie Mae, Wells Fargo, Discover, Citizens, with smaller/upcoming lenders College Ave, SoFi, Earnest, CommonBond, and Ascent. Nelnet has also entered the market. In-school private student loan market continues to grow Annual private student loan originations in billions Source: MeasureOne Source: MeasureOne Year over year growth rat...