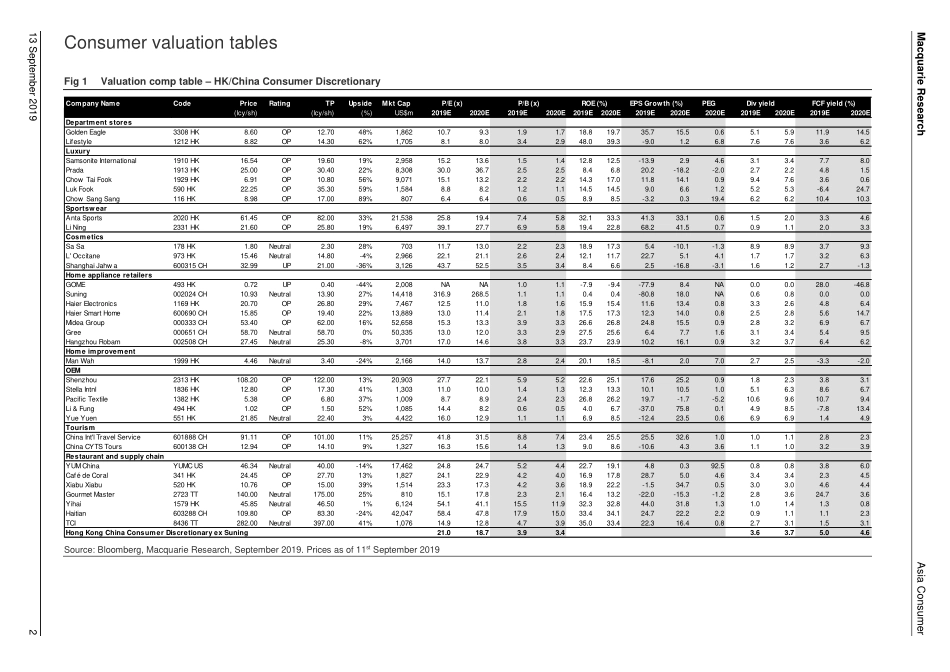

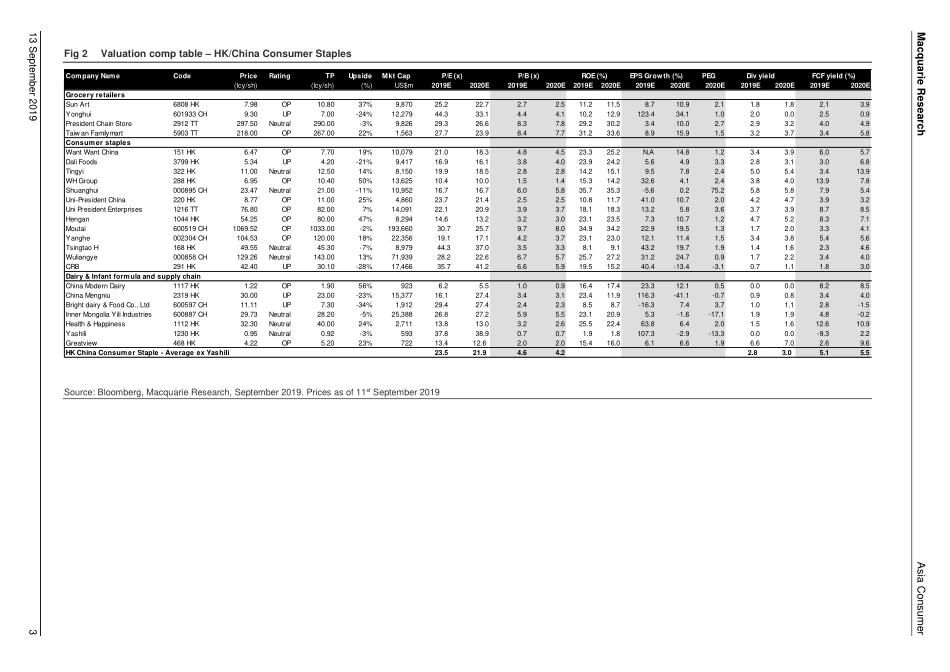

Please refer to page 47 for important disclosures and analyst certification, or on our website www.macquarie.com/research/disclosures. 13 September 2019 Global Inside Consumer valuation tables 2 China – High-end domestic consumption is rising 6 Korea – A tough time for large domestic cosmetics brands 11 Japan Cosmetics – Shiseido reasserts its brand leadership 15 China Int'l Travel Service (A-Share) (601888 CH) 20 Shiseido Co (4911 JP) 28 Pigeon (7956 JP) 31 Pola Orbis Holdings (4927 JP) 35 MacVisit: FANCL CORP 41 Estee Lauder (EL US) 43 EQUITIES Analysts Macquarie Capital Limited Linda Huang, CFA +852 3922 4068 linda.huang@macquarie.com Terence Chang +852 3922 3581 terence.chang@macquarie.com Sunny Chow +852 3922 3768 sunny.chow@macquarie.com Cici Yu +86 21 2412 9078 cici.yu@macquarie.com Hugo Shen +86 21 2412 9077 hugo.shen@macquarie.com Macquarie Securities Korea Limited Kwang Cho +82 2 3705 4953 kwang.cho@macquarie.com Gi Weon Park +82 2 3705 8632 giweon.park@macquarie.com Macquarie Capital Securities (Japan) Limited Leon Rapp +81 3 3512 7879 leon.rapp@macquarie.com Macquarie Capital (USA) Inc. Caroline Levy +1 212 231 1818 caroline.levy@macquarie.com Jesse Busch, CFA +1 212 231 1206 jesse.busch@macquarie.com Asia Consumer Beauty more than skin deep Key points We held a one-week Asia consumer tour across China, Korea and Japan. China: Rising high-end consumption. Japan: Focus on global brand strategic execution. Korea: tough time for large domestic cosmetics brands. Top buy ideas: Moutai, CITS, Shiseido, Pigeon, Estee Lauder. Top sell ideas: Mengniu, CRB, Pola Orbis, Kose, Amore Pacific. We recently held a one-week Asia consumer tour across China, Korea and Japan to understand changes in consumption behaviour, the growth outlook for travel retail and how superior brands from regional companies win over consumers. Post the trip, we uphold our bullish view that beauty and consumption upgrades remain structural tailwinds for the consumer sector. Our industry checks also indicate that travel retail is rising in importance for both consumers and brands. China – High-end domestic consumption is rising Beauty is the fastest growing consumer goods sector in China, as noted by the cosmetics expert and duty-free experts we met (each with >10 years of industry experience). In 2Q, we started to see the impact of China’s new e-commerce law on the beauty and health supplement supply chains. Baijiu ultra-premium is still in tight supply, with the wholesale price continuing to creep higher. However, the experts have lower confidence in price hikes. Revenue growth for condiments is likely to moderate but we expect this growth to continue at a decent mid-teens rate in 2019. A foreign beer brand has been taking market share in the premium beer sector while CRB is consolidating the mid-range market. Hengan’s market share for sanitary napkins a...