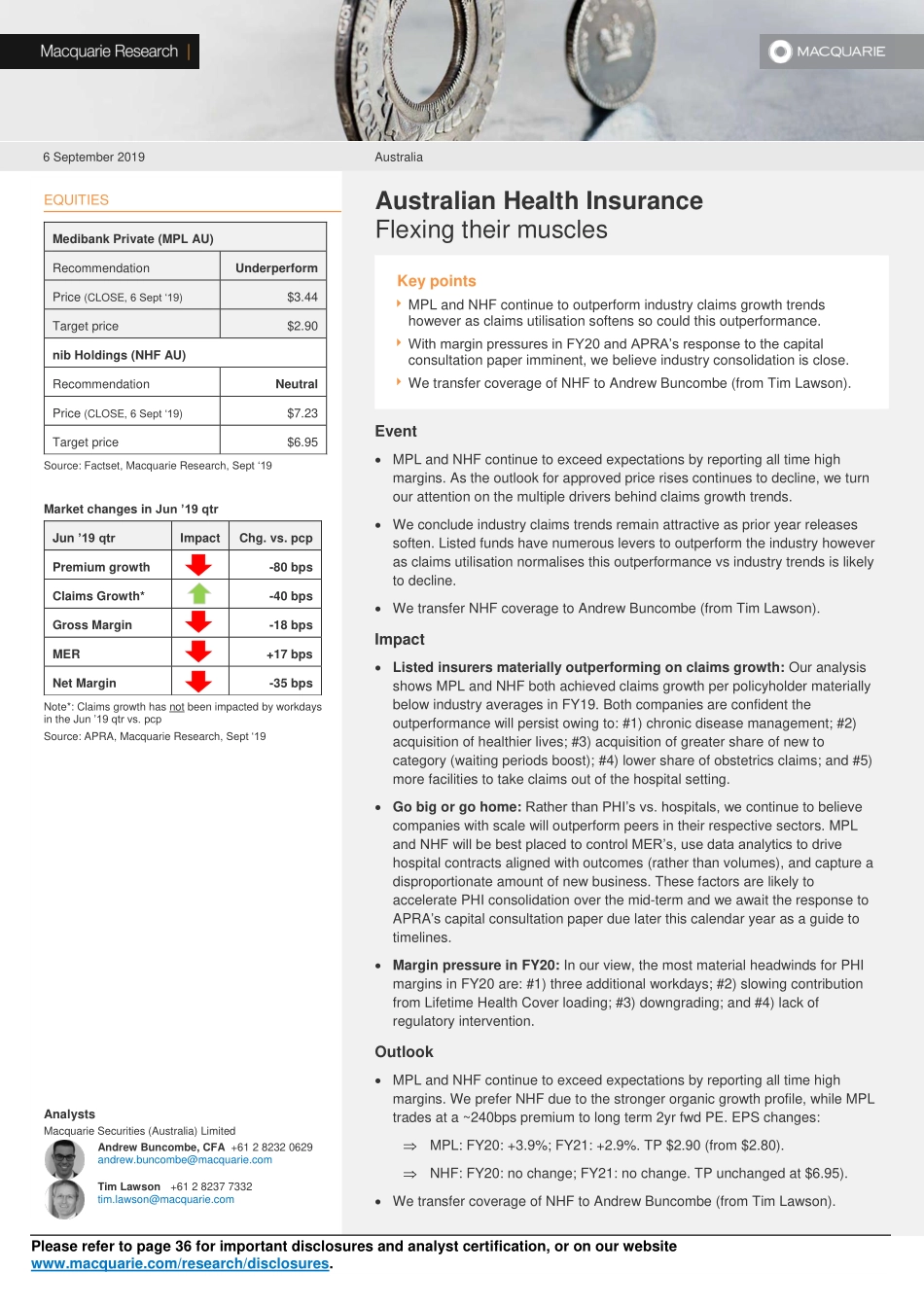

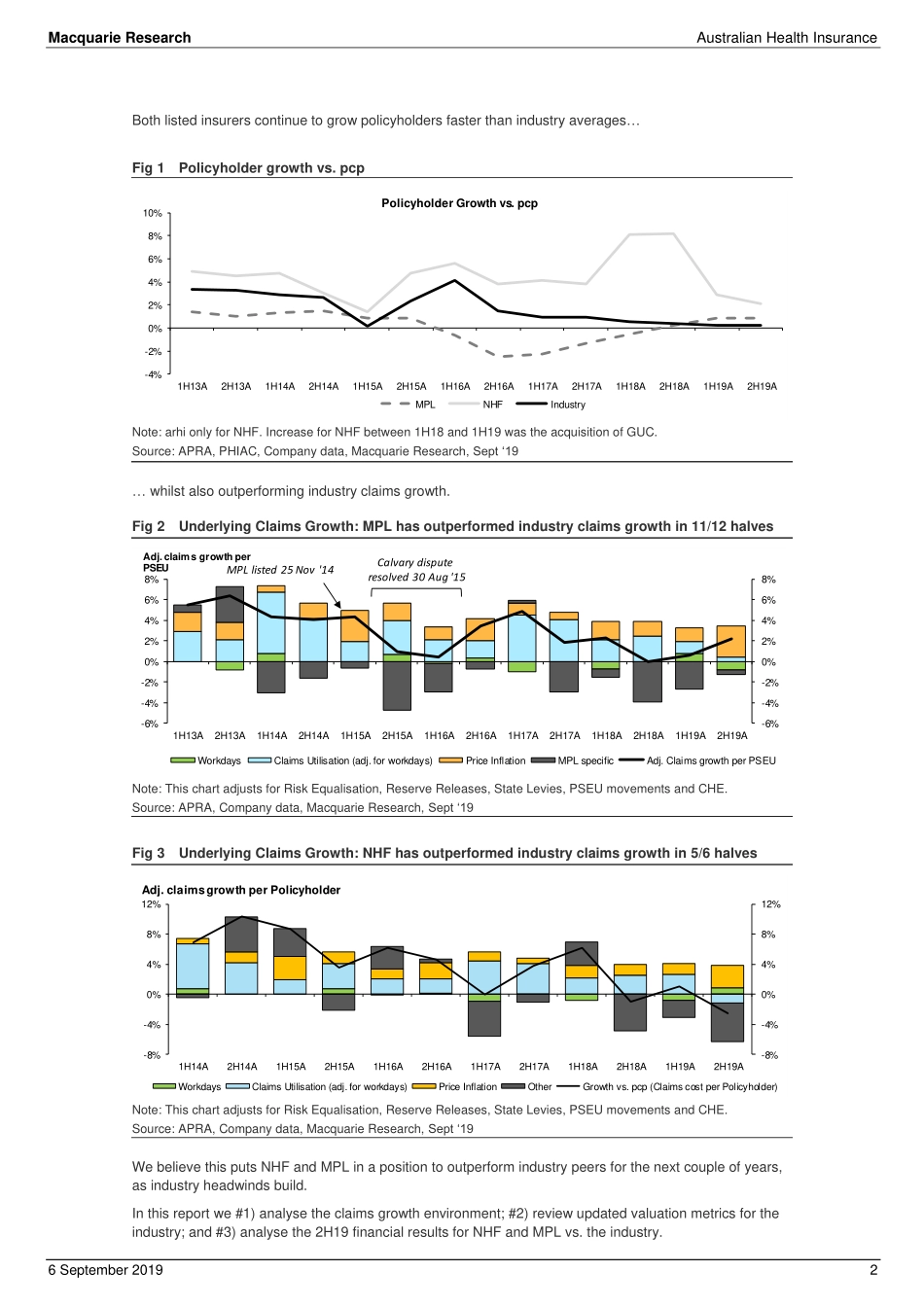

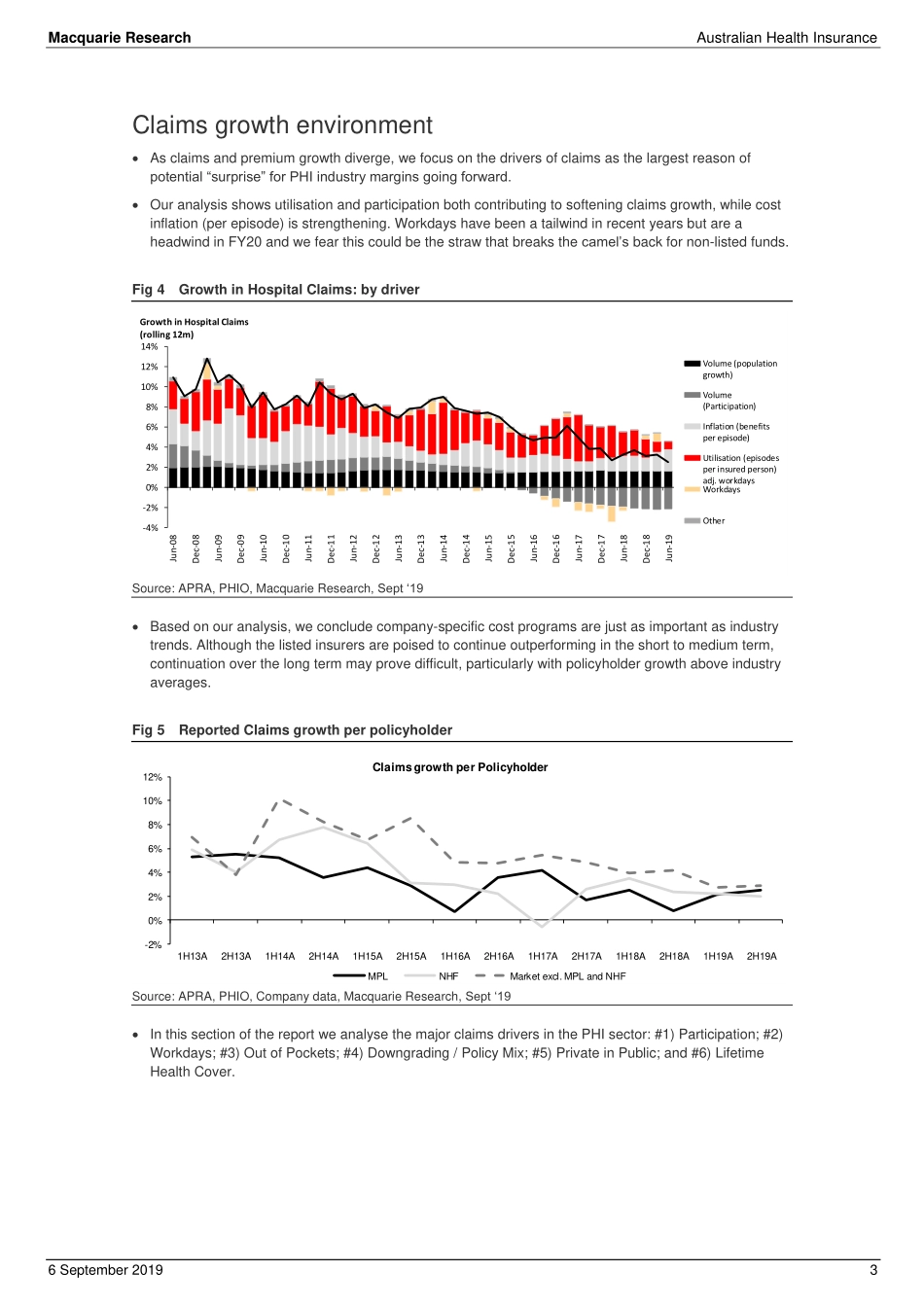

Please refer to page 36 for important disclosures and analyst certification, or on our website www.macquarie.com/research/disclosures. 6 September 2019 Australia EQUITIES Medibank Private (MPL AU) Recommendation Underperform Price (CLOSE, 6 Sept ‘19) $3.44 Target price $2.90 nib Holdings (NHF AU) Recommendation Neutral Price (CLOSE, 6 Sept ‘19) $7.23 Target price $6.95 Source: Factset, Macquarie Research, Sept ‘19 Market changes in Jun ’19 qtr Jun ’19 qtr Impact Chg. vs. pcp Premium growth -80 bps Claims Growth* -40 bps Gross Margin -18 bps MER +17 bps Net Margin -35 bps Note*: Claims growth has not been impacted by workdays in the Jun ’19 qtr vs. pcp Source: APRA, Macquarie Research, Sept ‘19 Analysts Macquarie Securities (Australia) Limited Andrew Buncombe, CFA +61 2 8232 0629 andrew.buncombe@macquarie.com Tim Lawson +61 2 8237 7332 tim.lawson@macquarie.com Australian Health Insurance Flexing their muscles Key points MPL and NHF continue to outperform industry claims growth trends however as claims utilisation softens so could this outperformance. With margin pressures in FY20 and APRA’s response to the capital consultation paper imminent, we believe industry consolidation is close. We transfer coverage of NHF to Andrew Buncombe (from Tim Lawson). Event MPL and NHF continue to exceed expectations by reporting all time high margins. As the outlook for approved price rises continues to decline, we turn our attention on the multiple drivers behind claims growth trends. We conclude industry claims trends remain attractive as prior year releases soften. Listed funds have numerous levers to outperform the industry however as claims utilisation normalises this outperformance vs industry trends is likely to decline. We transfer NHF coverage to Andrew Buncombe (from Tim Lawson). Impact Listed insurers materially outperforming on claims growth: Our analysis shows MPL and NHF both achieved claims growth per policyholder materially below industry averages in FY19. Both companies are confident the outperformance will persist owing to: #1) chronic disease management; #2) acquisition of healthier lives; #3) acquisition of greater share of new to category (waiting periods boost); #4) lower share of obstetrics claims; and #5) more facilities to take claims out of the hospital setting. Go big or go home: Rather than PHI’s vs. hospitals, we continue to believe companies with scale will outperform peers in their respective sectors. MPL and NHF will be best placed to control MER’s, use data analytics to drive hospital contracts aligned with outcomes (rather than volumes), and capture a disproportionate amount of new business. These factors are likely to accelerate PHI consolidation over the mid-term and we await the response to APRA’s capital consultation paper due later this calendar year as a guide to timelines. Margi...