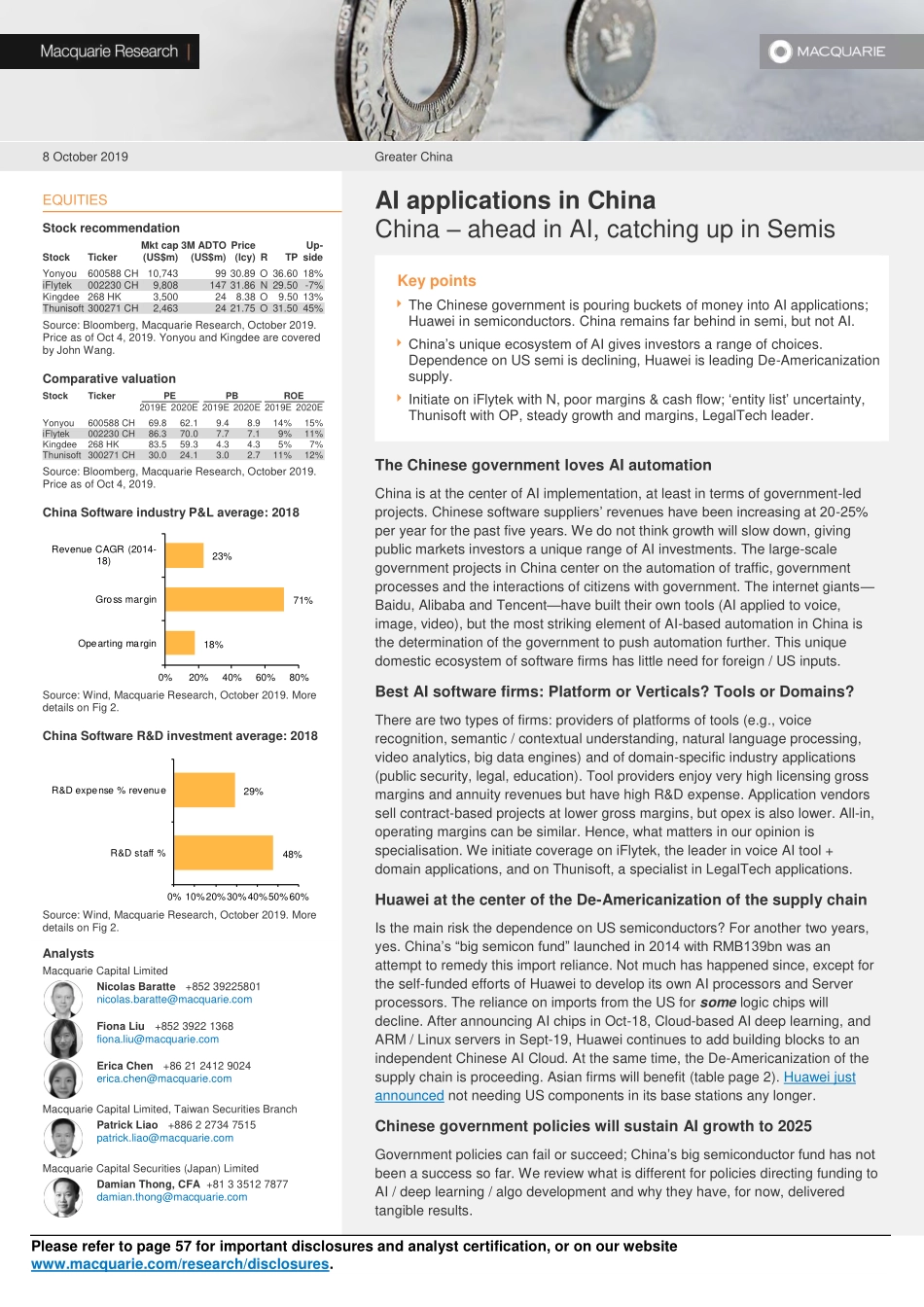

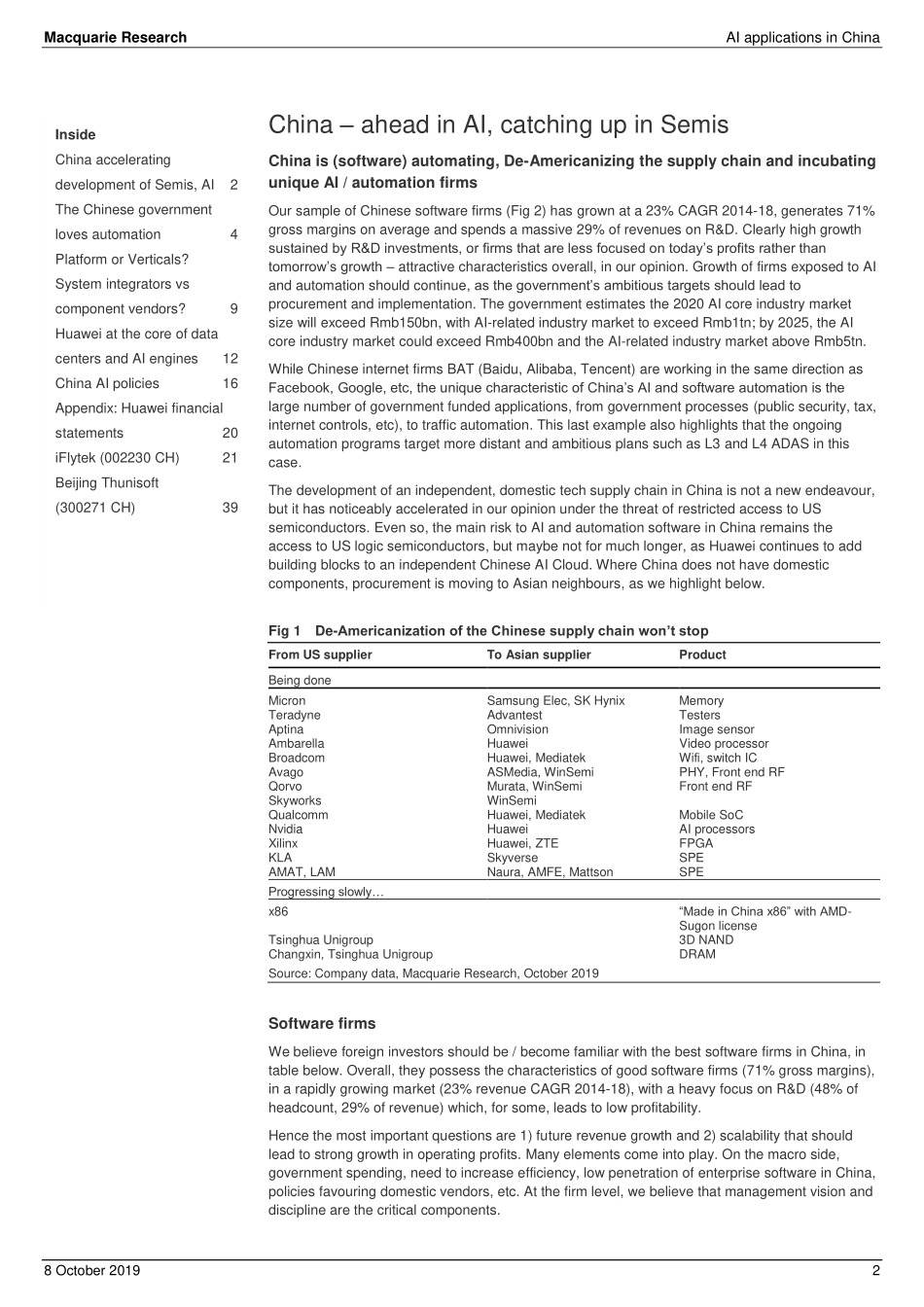

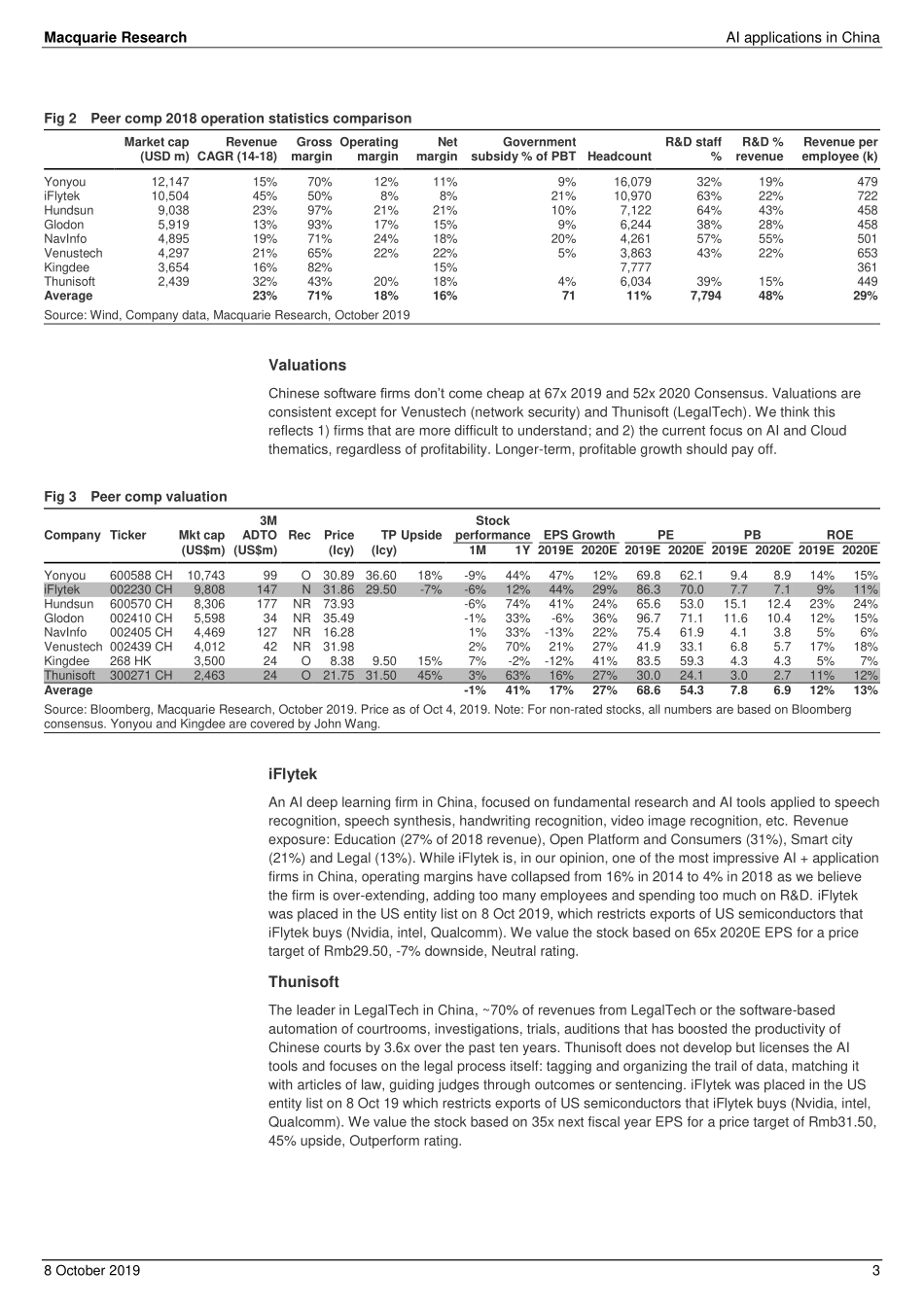

Please refer to page 57 for important disclosures and analyst certification, or on our website www.macquarie.com/research/disclosures. 8 October 2019 Greater China EQUITIES Stock recommendation Stock Ticker Mkt cap (US$m) 3M ADTO (US$m) Price (lcy) R TP Up-side Yonyou 600588 CH 10,743 99 30.89 O 36.60 18% iFlytek 002230 CH 9,808 147 31.86 N 29.50 -7% Kingdee 268 HK 3,500 24 8.38 O 9.50 13% Thunisoft 300271 CH 2,463 24 21.75 O 31.50 45% Source: Bloomberg, Macquarie Research, October 2019. Price as of Oct 4, 2019. Yonyou and Kingdee are covered by John Wang. Comparative valuation Stock Ticker PE PB ROE 2019E 2020E 2019E 2020E 2019E 2020E Yonyou 600588 CH 69.8 62.1 9.4 8.9 14% 15% iFlytek 002230 CH 86.3 70.0 7.7 7.1 9% 11% Kingdee 268 HK 83.5 59.3 4.3 4.3 5% 7% Thunisoft 300271 CH 30.0 24.1 3.0 2.7 11% 12% Source: Bloomberg, Macquarie Research, October 2019. Price as of Oct 4, 2019. China Software industry P&L average: 2018 Source: Wind, Macquarie Research, October 2019. More details on Fig 2. China Software R&D investment average: 2018 Source: Wind, Macquarie Research, October 2019. More details on Fig 2. Analysts Macquarie Capital Limited Nicolas Baratte +852 39225801 nicolas.baratte@macquarie.com Fiona Liu +852 3922 1368 fiona.liu@macquarie.com Erica Chen +86 21 2412 9024 erica.chen@macquarie.com Macquarie Capital Limited, Taiwan Securities Branch Patrick Liao +886 2 2734 7515 patrick.liao@macquarie.com Macquarie Capital Securities (Japan) Limited Damian Thong, CFA +81 3 3512 7877 damian.thong@macquarie.com AI applications in China China – ahead in AI, catching up in Semis Key points The Chinese government is pouring buckets of money into AI applications; Huawei in semiconductors. China remains far behind in semi, but not AI. China’s unique ecosystem of AI gives investors a range of choices. Dependence on US semi is declining, Huawei is leading De-Americanization supply. Initiate on iFlytek with N, poor margins & cash flow; ‘entity list’ uncertainty, Thunisoft with OP, steady growth and margins, LegalTech leader. The Chinese government loves AI automation China is at the center of AI implementation, at least in terms of government-led projects. Chinese software suppliers’ revenues have been increasing at 20-25% per year for the past five years. We do not think growth will slow down, giving public markets investors a unique range of AI investments. The large-scale government projects in China center on the automation of traffic, government processes and the interactions of citizens with government. The internet giants— Baidu, Alibaba and Tencent—have built their own tools (AI applied to voice, image, video), but the most striking element of AI-based automation in China is the determination of the government to push automation further. This unique domestic ecosystem of software firms has little need for foreign / US ...