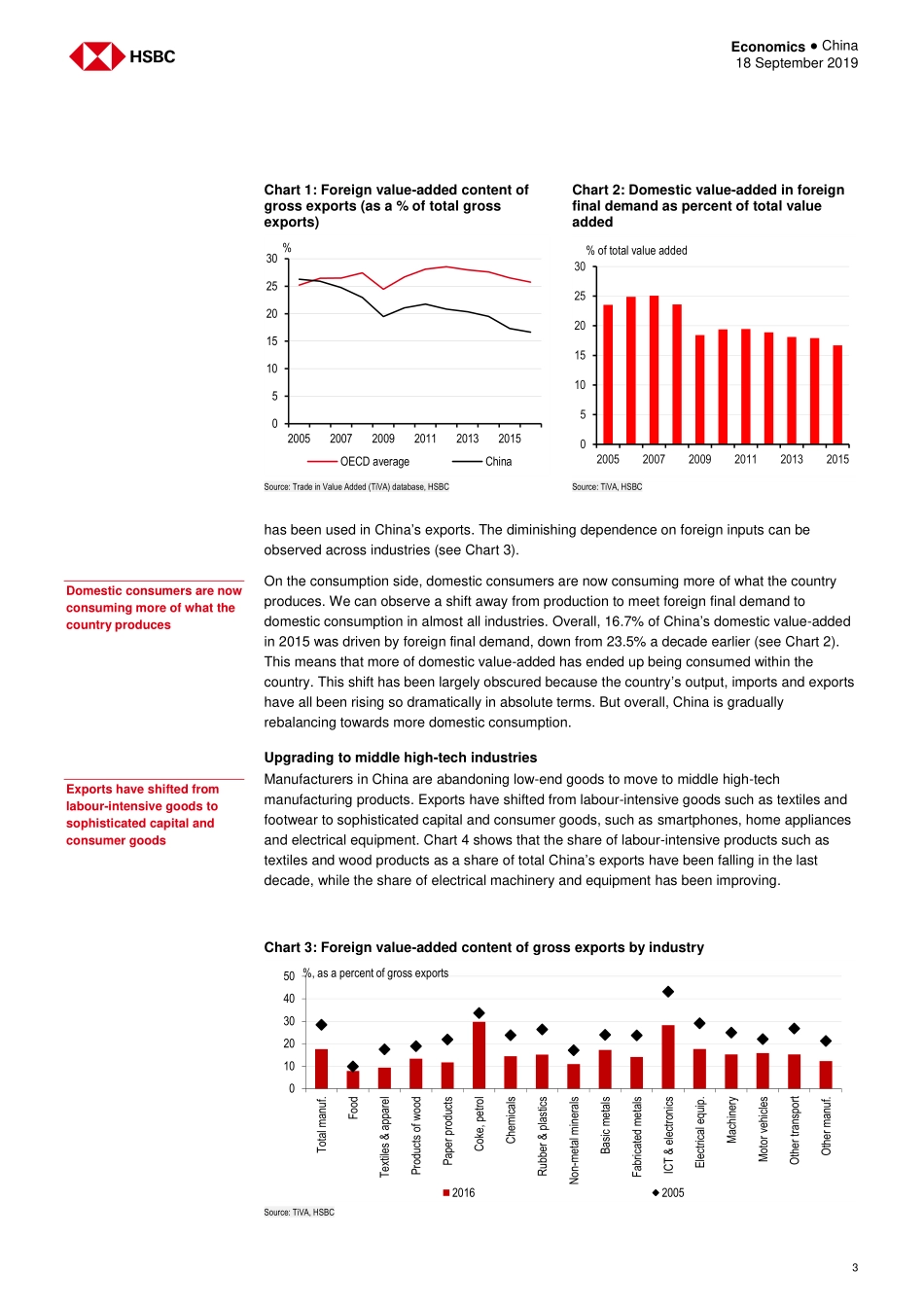

Disclosures & Disclaimer This report must be read with the disclosures and the analyst certifications in the Disclosure appendix, and with the Disclaimer, which forms part of it. Issuer of report: The Hongkong and Shanghai Banking Corporation Limited View HSBC Global Research at: https://www.research.hsbc.com Monday, 14th October 2019 | LondonRegister nowHSBC Global Investment Seminar As the trade war drags on, manufacturers in labour-intensive sectors may speed up relocation to lower-cost neighbours But for the high value-added supply chain, the shift is likely to remain slow as China retains many key pull factors Faster reform and opening up holds the key to mitigating the risks Weaker exports and business sentiment aside, the escalating China-US trade war has started to cause some distortions to supply chains. We estimate the announced US tariffs on USD550bn of Chinese goods, if they persist, could affect up to 5% of total manufacturing production in China. This report assesses the impact of the trade war on China’s supply chains. We find that it won’t be evenly distributed across sectors. For example, furniture, textiles and apparel and other labour-intensive sectors will likely be hurt the most due to their direct exposure to the US tariffs and sensitivity to rising labour costs in China. Even before the trade war started, companies in these sectors had already started gradually relocating their factories to Vietnam and other neighbouring countries where the average wage is less than half of China’s. The trade war will likely reinforce this trend. Meanwhile, some high value-added sectors, such as electronics and electrical equipment, are also being directly hit by the US tariffs and bans on hi-tech exports. But any effect on supply chains in high value-added sectors is likely to remain slow and limited for three reasons. First, China has become the largest market in the world for a slew of hi-tech products. For example, China accounted for 47.7% of worldwide sales of consumer electronics in 2018, according to Statista. Many high value-added products made in China are consumed in China. Second, since China joined the WTO in 2001, many coastal cities have become the central point of an integrated global network of supply vendors and production facilities. Millions of local firms are now on hand to provide intermediate inputs and ancillary services, making production quicker, less expensive and more efficient. Combined with improved infrastructure and the sheer size of the skilled labour pool, this points to a significant “lock-in” effect in the supply chains. As a result, even if some companies choose to move US-bound production out of China to dodge the US tariffs, they still retain the bulk of operations in China to serve China and other markets. China can accelerate reform and opening up to enhance thes...