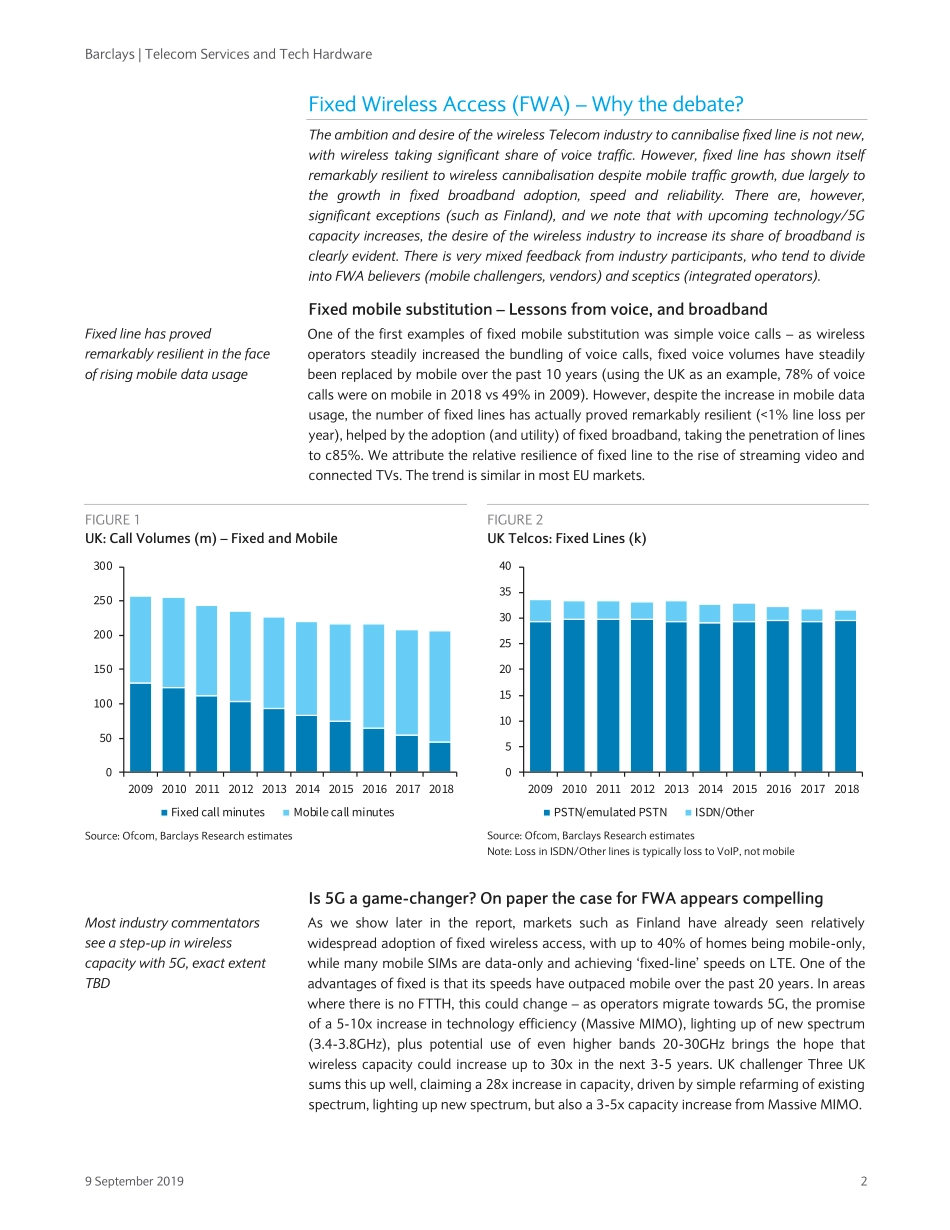

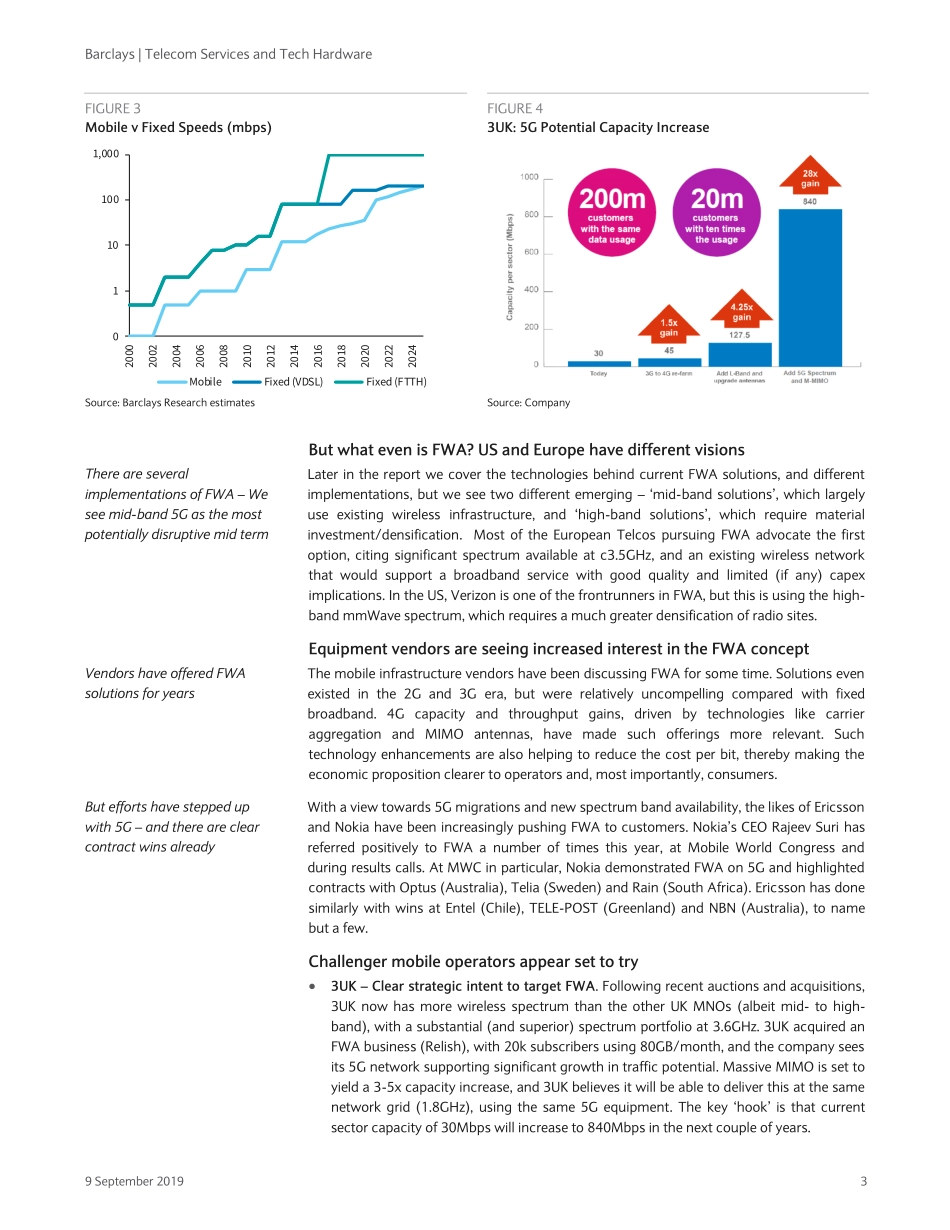

Equity Research 9 September 2019 FOCUS Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. This research report has been prepared in whole or in part by equity research analysts based outside the US who are not registered/qualified as research analysts with FINRA. PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 41. Restricted - Internal Telecom Services and Tech Hardware 5G – The Return of Fixed Substitution Fixed Wireless Access (FWA) has until now been a relatively niche service offering. This is about to change. The advent of 5G brings significant capacity increases to wireless networks, and we see mobile challengers set to seize on this to attack fixed broadband, especially in markets that lack meaningful FTTH (UK/Germany/Italy). Our extensive research and conversations with key market participants lead us to conclude that mobile challengers will be incentivised to capitalize on this opportunity, as near-term risks are very low, and business case appears compelling. FWA business case appear compelling with 5G – Most challengers will likely try. We estimate a >10x increase in wireless capacity over the next 5 years, as 5G brings greater spectrum efficiency, with more spectrum also becoming available. For mobile operators this will allow them to manage ever-increasing wireless demand. Crucially, they will also be able to consider offering high-speed broadband over wireless as an alternative to fixed. The near-term FWA investment risks for mobile operators are low, as any capex needs are both incremental and success-based, and initially very modest. FWA as a ‘copper killer’ – We see 5-10% of broadband market at risk from FWA. Our detailed analysis uses unique and proprietary data to look at the market opportunity for mobile operators to target urban, suburban and rural areas with FWA. Our research indicates a network cost of just c€5-10/sub/month, assuming c50-100mbps speeds. We identify 5-10% of the fixed broadband market at risk (with greatest risk in copper-heavy markets such as the UK/Germany/Italy, lower in FTTH-heavy markets). Stock implications – EU and US Telcos. We see increased broadband price competition from FWA solutions into the Consumer segments in markets like the UK, Germany, Italy and US, which is unhelpful for sentiment, with BT/TI/DT most exposed (on the other hand, DT has positive exposure through TMUS). In terms of EU-based beneficiaries, we see TEF De (OW), Drillisch (OW) and Sunrise (EW) as positively exposed, and separately initiate coverage on Big Blu Broadband...