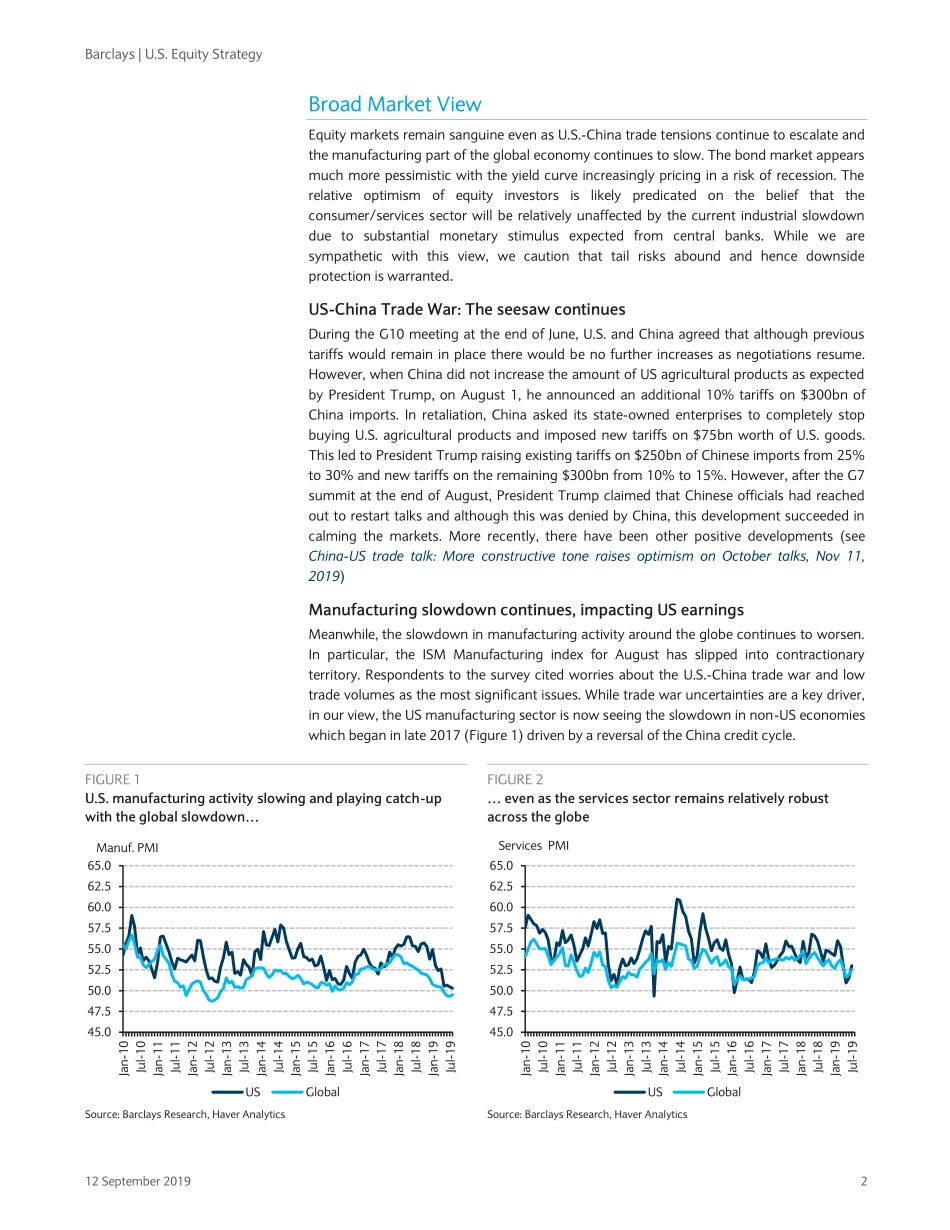

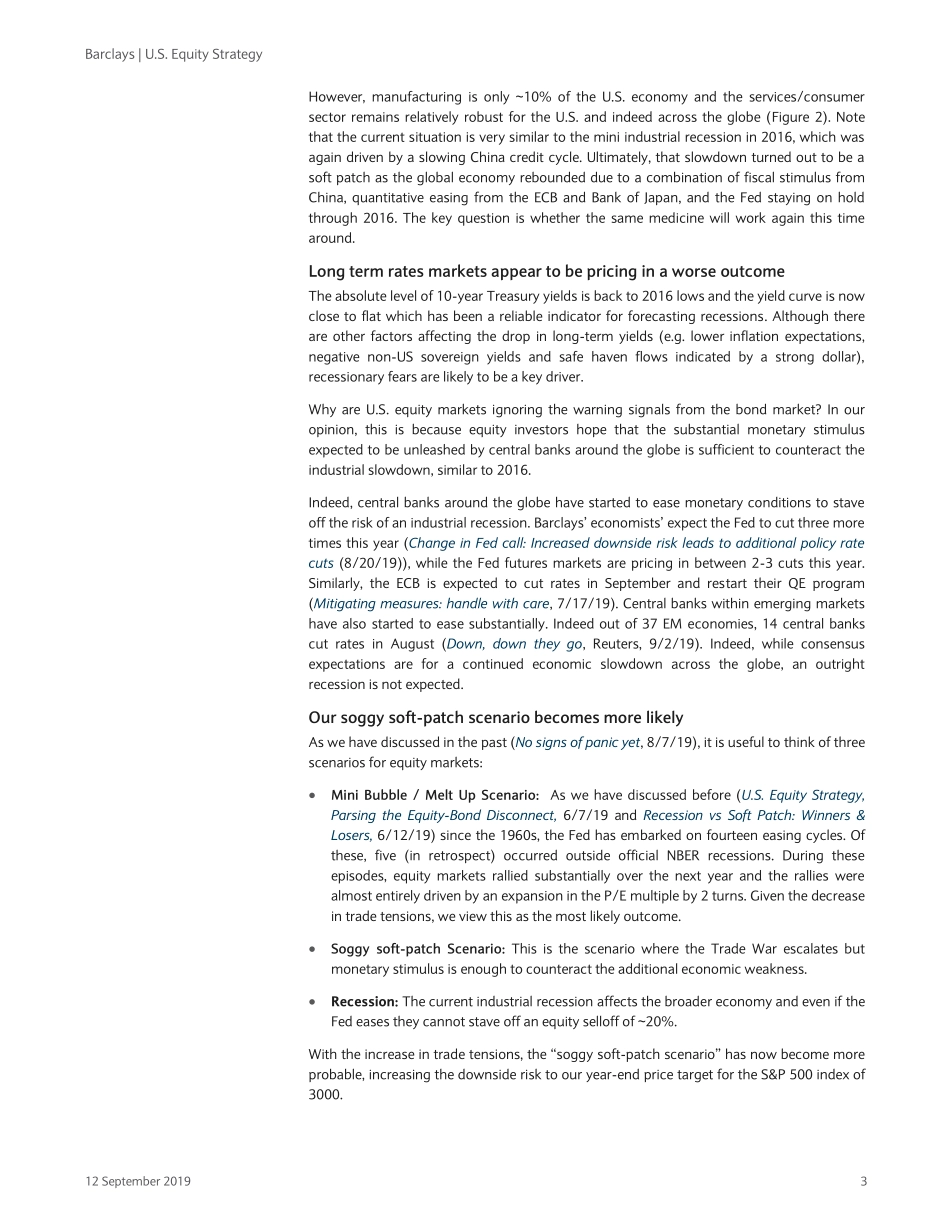

Equity Research 12 September 2019 FOCUS Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. PLEASE SEE ANALYST CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 29. Restricted - Internal U.S. Equity Strategy Sector Allocation: A Nuanced View We update our sector views using a multi-pronged approach. We are OW Software, FANG, Healthcare; MW Industrials, Consumer Staples, Consumer Discretionary (ex FANG), Communication Services (ex FANG); and UW Financials, Energy+Materials, Hardware+Semiconductors and Utilities+Real Estate. Our ratings are based on a multi-pronged approach, where we marry our quantitative framework for price appreciation, the sector allocations of our optimal business cycle stage baskets, downside risk exposure due to further escalation of the U.S.-China trade war, performance in previous soft patches accompanied by aggressive Fed easing, and Industry-specific factors for each sector. A substantial change in our methodology is that we construct customized sectors for the S&P 500 index for which the index weights are more balanced. We also split the InfoTech sector into a Software and Hardware+Semiconductor sector given the different drivers for these industries. Finally, we create a separate FANG sector given the different drivers for these four stocks. Our quantitative approach is based on an EPS forecast which starts with consensus expectations but adjusts them based on their historical biases and stage of the business cycle. For actual projections we leverage the views of Barclays’ fundamental analysts to adjust consensus EPS projections. This is then combined with a model for each sector P/E ratio based on its historical relationship with the SPX P/E ratio. We next adjust the EPS or P/E projections of our model based on known Industry-specific factors. These include the divergence between consumer and industrial economic growth, low rate environment for financials, a patent cliff in healthcare, adoption of the software-as-a-service (SaaS) business model by many Software companies and regulatory overhang for FANG stocks. Besides the sector allocations of our optimal business cycle baskets, we also use the allocations based on historical industry performance during the five “soft patches” over the past 60 years. We define these to be the one-year Fed easing cycles which happened outside official NBER recessions. There is some probability that we are currently in a similar environment and we show that the optimal sector allocations were quite different during these episodes. Given the fluidity of the U.S.-Chin...