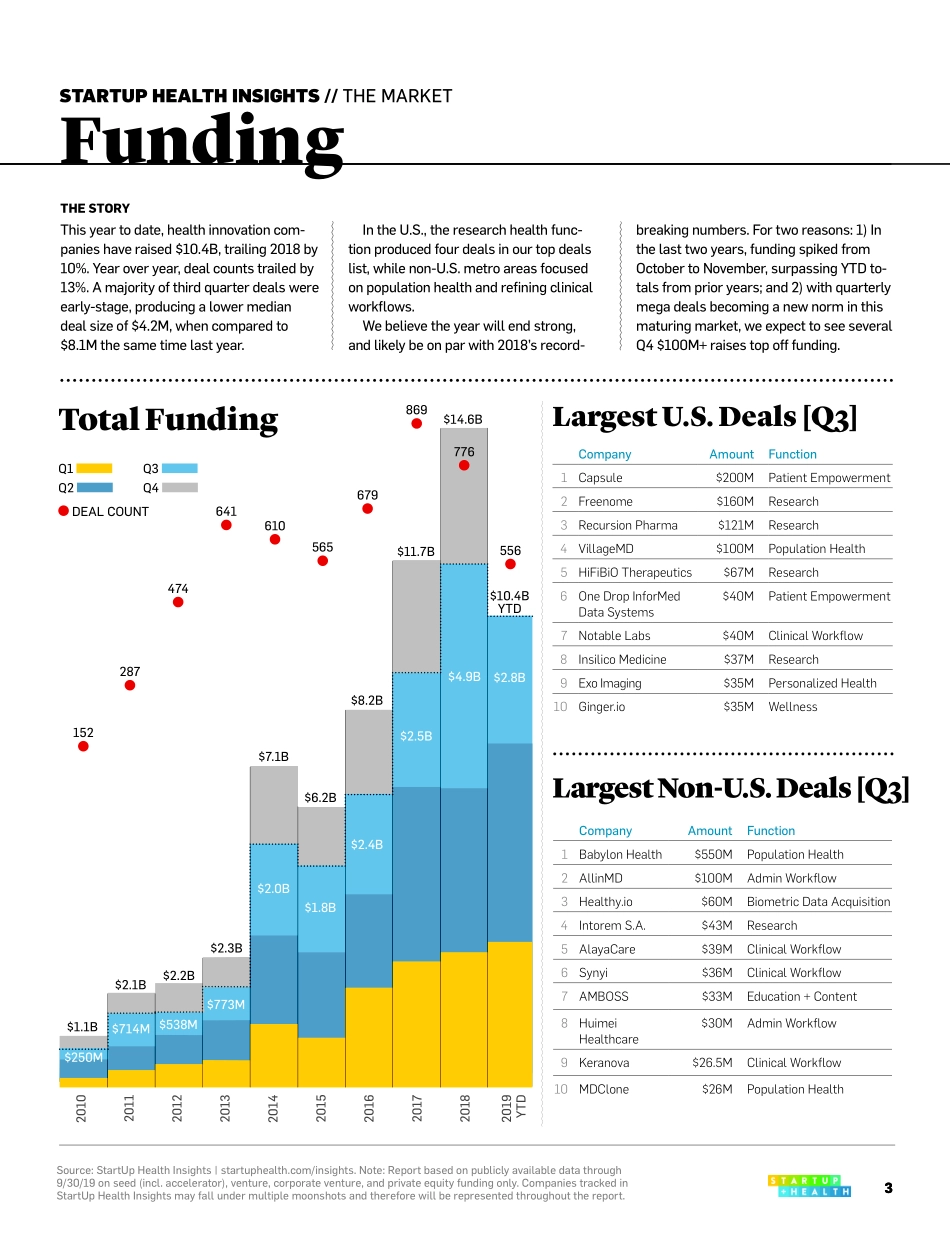

1 Issue 4 StartUp Health Magazine 1 2019 Q3StartUp Health Insights™A year-to-date report on health innovation and the health moonshots transforming the world.ABOUT STARTUP HEALTH INSIGHTS™ StartUp Health collects and shares market insights because these data points tell a critical part of the health innovation story. More than simply chronicling the flow of money, this report provides a glimpse into the overall progress of our health moon-shots. The story beneath the top-line figures opens up new challenges as well as oppor-tunities. Health moonshots require radical collaboration, so we encourage you to dig into this report and then bring your own in-sights to the table at hq.startuphealth.com.Report Authors Nicole Clark | Polina HaninContributors Anne Dordai | Jennifer HankinNicole Kinsey | Tara SalamoneDesign Logan Plaster---© 2019 StartUp Health Holdings, Inc. StartUp Health and Health Transformer and associated logos are registered trademarks of StartUp Health LLC. ABOUT STARTUP HEALTHStartUp Health is on a 30-year mission to collaborate with entrepreneurs to improve the health and wellbeing of everyone in the world. Since 2011, StartUp Health has been investing in a global army of entrepreneurs to achieve health moonshots and has the world’s largest health innovation portfolio with 300 companies across six continents and 24 countries. --- Join the movement at startuphealth.comSign up to receive weekly funding insights at startuphealth.com/insider®2 StartUp Health InsightsSTARTUP HEALTH INSIGHTSOverviewHealth Innovation Funding HighlightsKEY MARKETS SEE SPIKES IN FUNDINGIn the first three quarters of 2019, health innovation companies raised $10.4B. As is typical of this time of year, the third quarter saw a modest dip in funding. In fact, in seven of the past nine years, the third quarter was either flat or down from its preceding quarter. But this quarter offered multiple bright spots and exceptions.This quarter, funding in support of population health saw a jump of 200%, the highest of any function we track, bringing in over $720M in Q3 and $1.2B for the year. The Women’s Health and Access to Care Moonshots continue to enjoy a steady surge of capital for the year – $4.5B YTD for Access to Care and $295M YTD for Women’s Health – along with upticks in deal volume. This comes despite a politically charged time for both women’s health rights and global debates over government-sponsored healthcare models.The Addiction Moonshot, which saw a funding increase of 223%. Two health moonshots were up on QoQ deal count: Cancer with a 113% increase in volume and Addiction with a 100% jump. Women’s Health continued to lead from a YoY outlook, with funding up by 66%, and 65% more deals than this time last year. Access to Care is historically our most lucrative health moonshot by way of funding and deal count and remained so in Q...