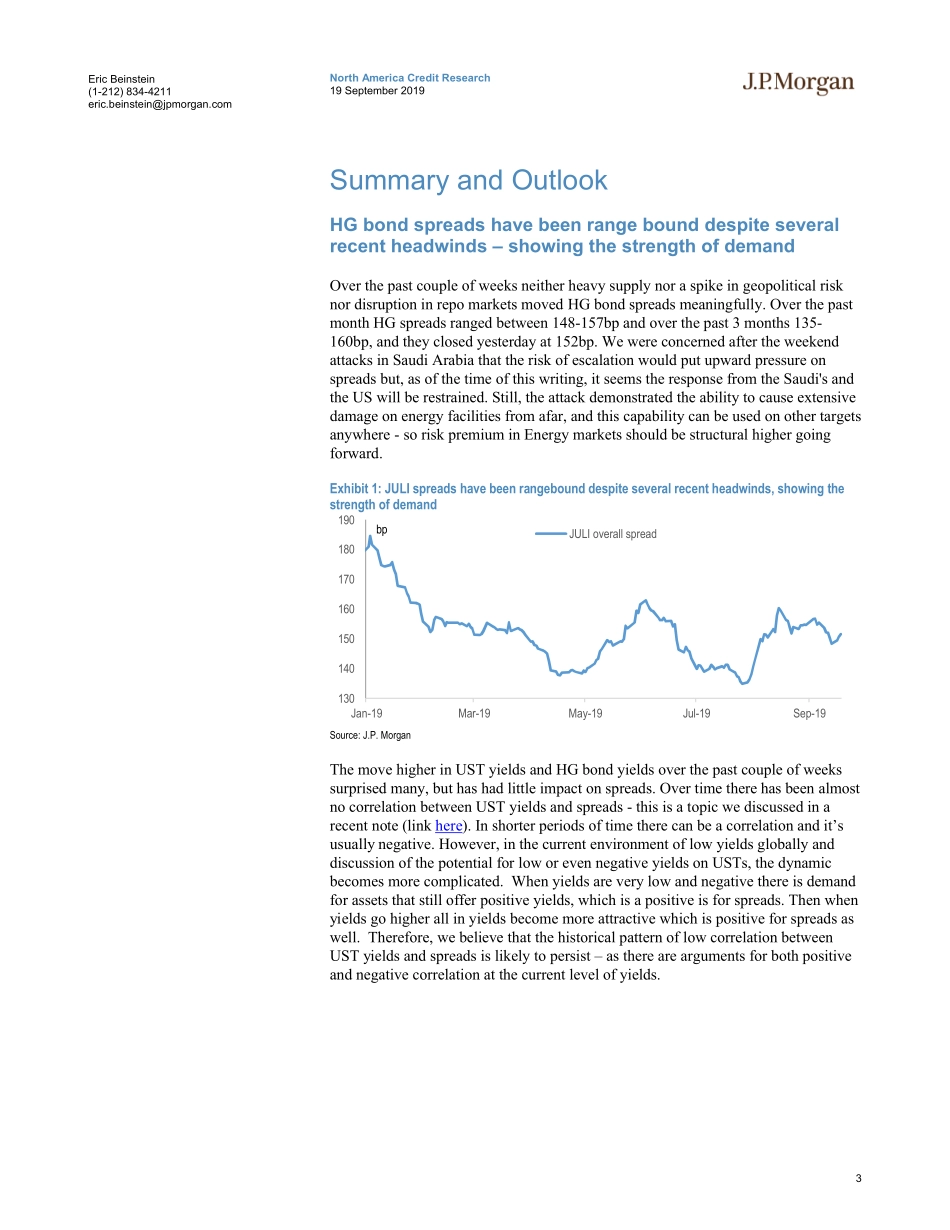

North America Credit Research19 September 2019 Credit Market Outlook & StrategyUS High Grade Strategy & CDS ResearchUS High Grade Strategy & Credit Derivatives ResearchEric Beinstein AC(1-212) 834-4211eric.beinstein@jpmorgan.comPavan D Talreja(1-212) 834-2051pavan.talreja@jpmchase.comSheila Xie(1-212) 834-3036sheila.xie@jpmorgan.comJ.P. Morgan Securities LLCSee page 39 for analyst certification and important disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.www.jpmorganmarkets.comHigh Grade StrategyHG bond spreads have been range bound despite several recent headwindsincluding the Saudi attack, repo market volatility and heavy supply –demonstrating the strength of demand. We raise our 2019 supply forecast by $100bn to $1.11tr, just 2% below last year’s outcome. We believe there is plenty of capacity to absorb the additional bonds. The average maturity of bonds issued YTD is more than 1yr longer than last year, so the duration-adjusted supply will likely be up y/y. History shows no correlation between monthly supply and monthly index spread performance. High Grade Credit Fundamentals through 2Q show weakness in EBITDA growth and leverage, but BBB leverage metrics are modestly improving. Overall profit margins remain strong. Fund flows show signs of a rebound in September after slowing in August. In the short end HG bonds are very wide to matching CDS. Pension funded status weakened in August but is rebounding in September. Credit DerivativesCDX.IG S33 starts trading this morning along with iTraxx S32 indices. There is only one name change for the new CDX.IG. We expect the new CDX.IG index to trade 7.5bp wider than the CDX.IG S32 index. This is marginally tighter than the roll fair value of 7.8bp. CDX.HY S33 rolls on September 27th. For the new HY series, there are four name changes. Based on fair value calculations the new HY index should trade 73 cents/27bp cheap to CDX.HY S32 version 2 index. However, we expect the new index to trade 5-10 cents richer than fair value levels. CDX.HY has outperformed CDX.IG in recent weeks leading to spread compression. We recommend positioning for CDX.HY underperformance in the near term. Finally, CDX.IG tranches roll on September 25th and CDX.HY tranches roll on October 2nd.Trade TrackerSince our last publication, our Trade Tracker is up $22,292. Over the last twelve months, performance is up by $1,060,284 (+6.2% ROI / +24.2% IRR).Chart of the week: We raise our supply forecast by about $100bn to be nearly the same as last year, and 12% below the 2017 peakNet supply is now forecast to be down 10% y/y, and down 37% from...