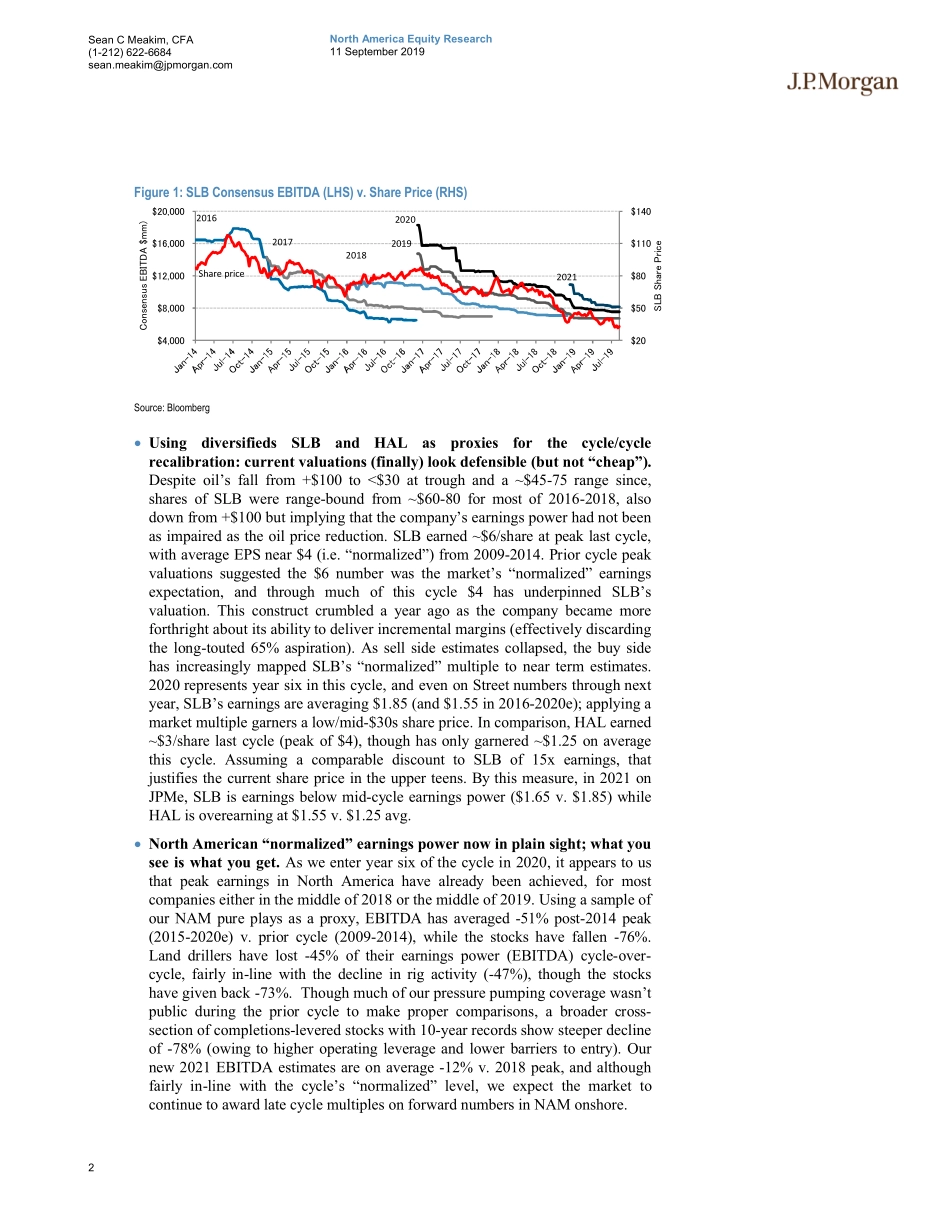

North America Equity Research11 September 2019 Oil Services & EquipmentThe Fall 2019 Playbook: Taking This Cycle to Its Natural Conclusion: 2015-2020e Is "Normalized"Oil Services and EquipmentSean C Meakim, CFA AC(1-212) 622-6684sean.meakim@jpmorgan.comBloomberg JPMA MEAKIM J.P. Morgan Securities LLCDanyel J Desa(91-22) 6157-3301danyel.j.desa@jpmchase.comJ.P. Morgan India Private LimitedAndrew P Herring, CFA(1-212) 622-8585andrew.p.herring@jpmorgan.comJ.P. Morgan Securities LLCCorey Mergenthaler(1-212) 622-1167corey.mergenthaler@jpmchase.comJ.P. Morgan Securities LLCSee page 23 for analyst certification and important disclosures, including non-US analyst disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.www.jpmorganmarkets.comOur annual Fall Playbook is intended to give investors our take on how to be positioned into yearend as well as provide a preview into the following year. We think the sector is in a tricky situation for investors; despite the rally over the past week, the stocks have taken another hard cut year-to-date on one more round of negative estimate revisions and multiple compression, and expectations of “normalized” earnings power for the group continues to map closer to the “here and now”, a reasonable conclusion as we approach the sixth year post-2014 peak. Our analysis suggests that parts of the coverage, while still not “cheap” v. the market, are finally approaching levels that reconcile with the earnings degradation of the current cycle. However, we still see meaningful reductions to consensus estimates coming, and (credible) fundamental upside catalysts appear lacking. We believe one of the most important fundamental questions to answer to get the stocks right in Oil Services is the direction of FY2 EBITDA revisions. For the third consecutive year, FY2 estimates are falling (-23% YTD), and as we look to next year, we are establishing 2021 estimates well below consensus, hardly a harbinger for outperformance. To illustrate, of the 30 stocks in our coverage, 27lagged the market YTD through 9/6; the three that led (FTI, DRQ, WTTR) all experienced positive revisions to their FY2 estimates. With this report, we are materially reducing our forecasted trajectory of the E&P capex cycle. Coming into 2019, we thought international spending would be able to sustain decent growth (M-HSD); however, we see risks of a deceleration next year ex-NAM. Meanwhile, the “faster, cheaper, better” shale cycle looks poised to deliver a contracting U.S. capex pie in the coming years, with upside surprises a shrinking portion of the probability distribution through a combin...