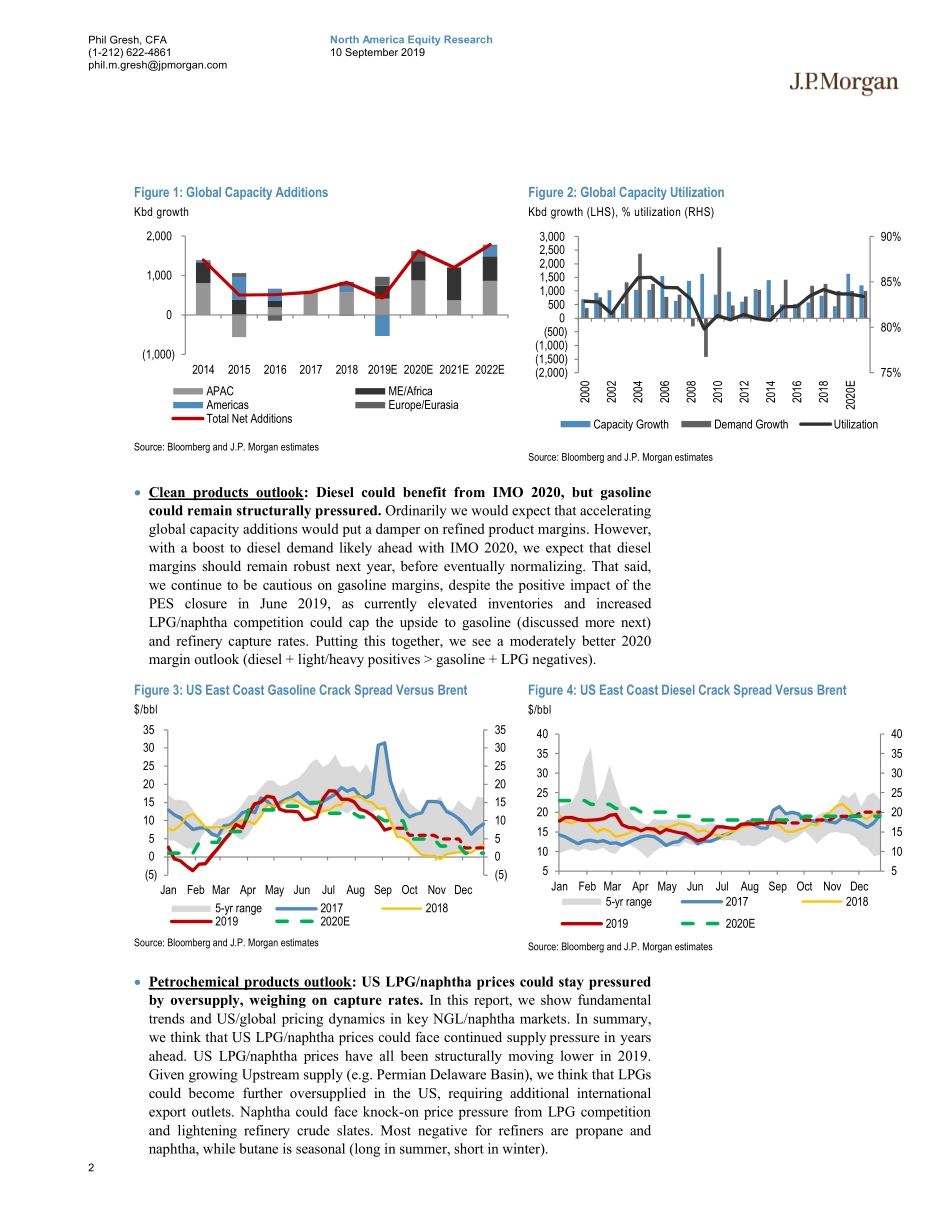

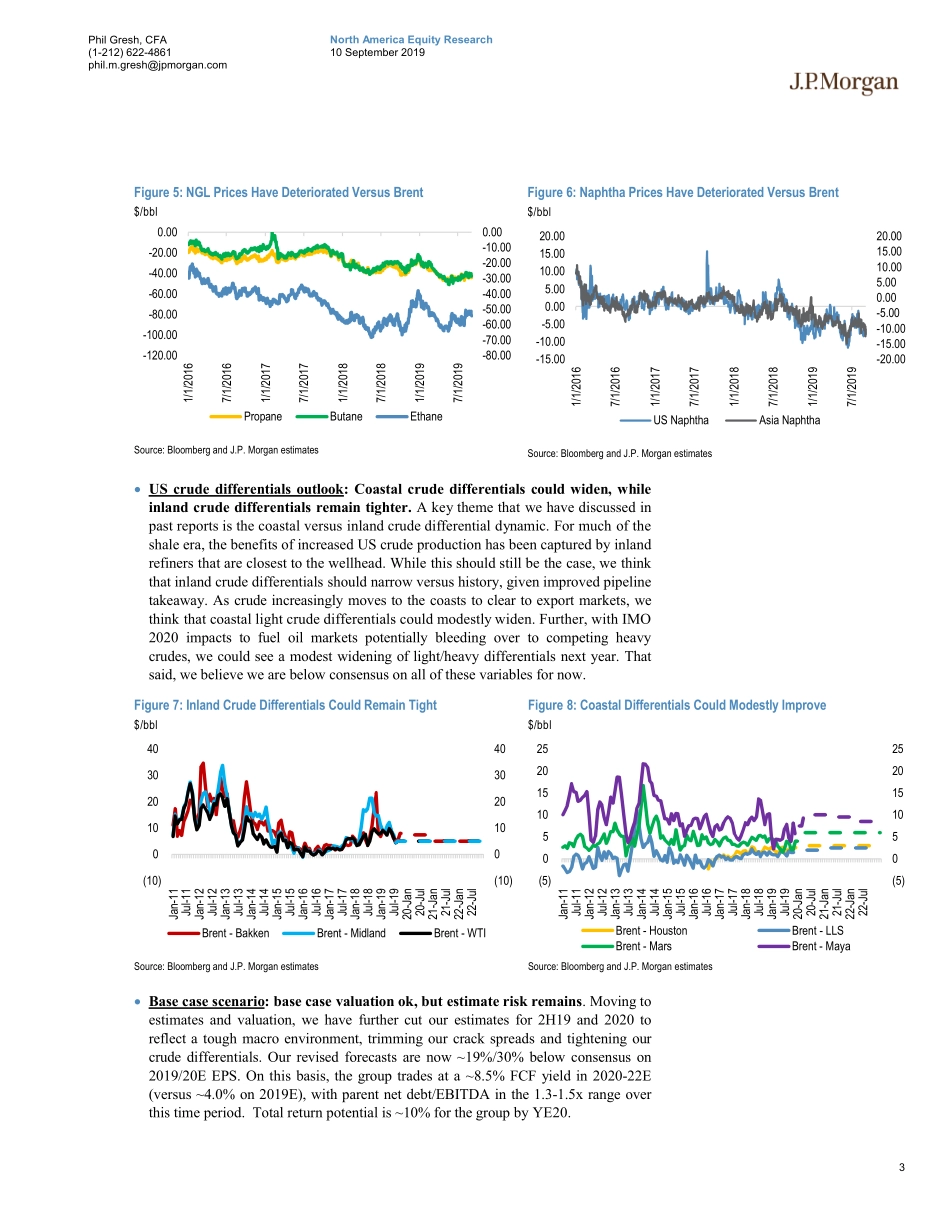

www.jpmorganmarkets.comNorth America Equity Research10 September 2019US Refining Industry Primer and Sector OutlookIntegrated Oils & RefiningPhil Gresh, CFA AC(1-212) 622-4861phil.m.gresh@jpmorgan.comBloomberg JPMA GRESH John M Royall, CFA(1-212) 622-6406john.m.royall@jpmorgan.comNicholas J Lampman(1-212) 622-9515nicholas.lampman@jpmorgan.comJ.P. Morgan Securities LLCSee page 167 for analyst certification and important disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.It has been five years since our US refining sector launch primer, so we decided to publish a new and improved version, with this 175+ page deep dive report. Looking back, the past five years have been positive for US refining stocks versus the rest of Energy (~10% capital appreciation versus XLE down ~40%), but have had a tough time keeping up with the market (S&P up ~50%). Five companies have been rolled up (ANDV, ALJ, NTI, WNR, CVRR), while the remainder have had an annual total return of capital (dividend + buybacks) yield of ~7%. We believe that this solid performance has been driven by a “goldilocks” fundamental backdrop of strong product demand and cheap US crude feedstocks (despite the crude export ban being lifted in 2015, a key risk at the time of our first primer). With IMO 2020 just around the corner, perhaps the goldilocks scenario can continue a bit longer for diesel; however, overall product margin upside could be limited by global capacity additions and gasoline/petrochemical (e.g. propane/naphtha) margin headwinds. Meanwhile, US light crude feedstock benefits could also become more limited by improved pipeline takeaway and export capacity, leading to narrower US crude differentials. Bottom line, while IMO 2020 should be positive for US refiners, offsetting headwinds keep us 19%/30% below consensus on 2019-20 sector average EPS. On this basis, we show sector average FCF yield of ~4.0% on below normalized 2019E, but ~8.5% thereafter in 2020-22E, factoring in continued buybacks, with parent net debt/EBITDA in the 1.3-1.5x range throughout. On this basis, we see ~10% total return potential by YE20, following a >10% move higher in recent days. We also ran a hypothetical 2020E downside case, where IMO 2020 provides limited benefits and differentials remain tighter, on which FCF yield is similar to 2019 at ~4% and parent leverage is ~2.3x, which could lead to significant downside for the group. On the stocks, we continue to favor coastal refiners (OW-rated MPC, PSX and VLO), who have an opportunity for modestly wider coastal differentials for both light (MEH/LLS) and heavy (Maya/WCS)...