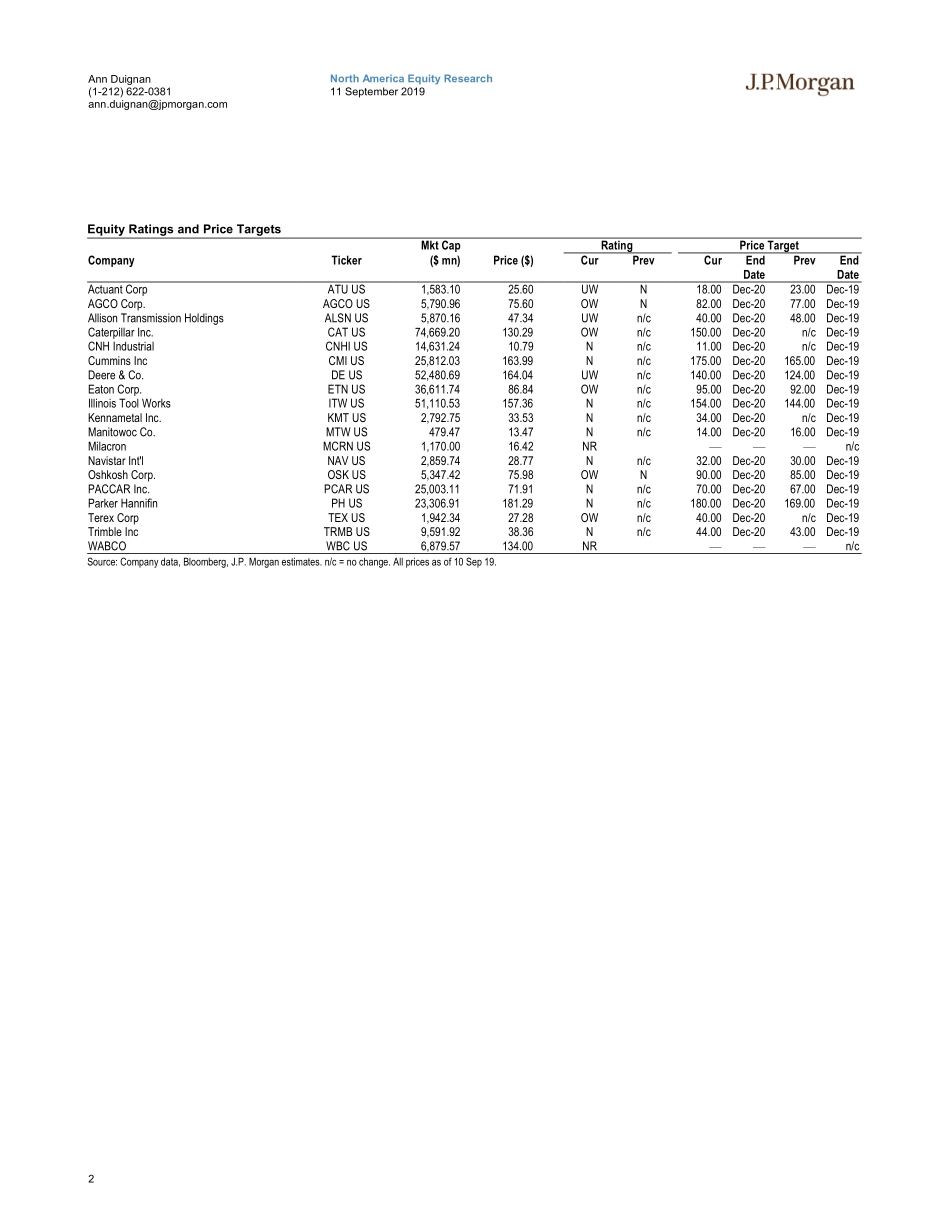

www.jpmorganmarkets.comNorth America Equity Research11 September 2019US MachineryRatings Changes And 2020 Price TargetsMachineryAnn Duignan AC(1-212) 622-0381ann.duignan@jpmorgan.comBloomberg JPMA DUIGNAN J.P. Morgan Securities LLCThomas Simonitsch(1-212) 622-2250thomas.simonitsch@jpmorgan.comJ.P. Morgan Securities LLCNatalia Vaysblit-Vitebskiy(1-212) 622-8835natalia.vaysblit-vitebskiy@jpmorgan.comJ.P. Morgan Securities LLCBhanu P Koduru(91-22) 6157-3607bhanu.koduru@jpmchase.comJ.P. Morgan India Private LimitedSee page 44 for analyst certification and important disclosures, including non-US analyst disclosures.J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision.Our US Machinery coverage universe has underperformed the broader market YTD (up 18% vs. S&P 500 up 21%) but has outperformed since Labor Day (up 8% vs. S&P 500 up 2%) with a rotation into cyclicals. We are establishing our December 2020 price targets based on where we believe we are in the cycle for end market demand, with NA & EU truck at/beyond peak, NA construction equipment perhaps rolling over in 2020, NA agriculture equipment demand likely stagnating near mid-cycle and mining equipment slowly approaching mid-cycle. We are upgrading AGCO and OSK to Overweight as both stocks appear undervalued (even following the strong run so far this month) with relativelylimited downside risk to earnings. Additionally, we are downgrading ATU to Underweight as the risks appear weighted to the downside at current valuation. Upgrading OSK and AGCO to Overweight. Machinery stocks generally trade at ~10x peak earnings and ~20x trough. OSK valuation is compelling (9.7x consensus P/E) andwe see upside potential for further earnings growth. While Access Equipment is expected to face cyclical headwinds in FY’20, there is good visibility into its Defense business as well as its Fire & Emergency and Commercial segments, which should support additional earnings growth and lower earnings volatility beyond FY’20. AGCOvaluation is also compelling (13.6x consensus P/E) with fairly limited downside risk to earnings given its SA/EU regional mix (limited exposure to NA row crop). Downgrading ATU to Underweight on valuation. The stock is trading at ~24x consensus2020 EPS, well above its 3, 5 and 10-year average P/E multiple; the risks appear weighted to the downside at current valuation. In particular, we see elevated risk of management overpaying for acquisitions should it pursue the pipeline of potential targets. Remain Overweight on ETN, CAT and TEX; Underweight DE and ALSN. ETNcontinues to trade at a significant discount to its conglomerate peers and its...